Mastering Candlestick Charts: A Step-by-Step Guide to Making Better Trades

Welcome to a new episode of BullAcademy, whereby in-depth discussions into the very fundamentals of trading are made in order to help yourself improve and become a better trader. Today, our topic is going to cover one of the most important tools of the trader, namely the candlestick charts. In this video, we will look closer at the candlesticks themselves – the very important constituent of each and every trader’s armory. One of the premises that will be crucial on your journey to improved market analysis and decision-making is mastering them.

The Popularity and Power of Candlestick Charts

Of all chart types, candlestick charts are, by far, the most widely used in financial trading. Other chart types, such as line and bar charts, are also in use, but the information carried by candlestick charting is much deeper concerning the price movements. These charts let traders see not just where prices have been but also how prices moved within each time period, thus giving a much clearer view of market sentiment.

A Brief History of Candlesticks

First originating in the 18th century, the candlestick chart was invented by a Japanese rice trader named Munehisa Homma. He used these candlestick charts to keep a tab on rice prices for more accurate prediction of market movement. Surprisingly, until the founder of Dow Theory in the U.S., Charles Dow-the concept started to creep into the western world, even though he himself struggled to get it running.

Fast forward to the 1990s, when the trader/author Steve Nison helped bring candlestick charting into the Western mainstream with his 1991 book entitled Japanese Candlestick Charting Techniques. This work by him, in particular, helped revolutionize the way in which traders analyzed the market data and the candlesticks became a chart of choice for traders across the world.

The Basic Components of a Candlestick

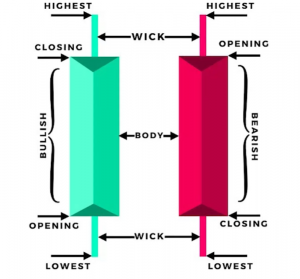

Basically, a candlestick is made up of four major components: the open, the close, the high, and the low. These are the basic components of the appearance and color of the candlestick.

- Open: The price in which the asset opens for the given time period.

- Close: This represents the price at which the asset closes for the given time period.

- High: During the occurrence of this price within the period, it is the highest price reached.

- Low: Like the high price, it occurs during the period-the lowest reached.

When you view a candlestick, the body of it would represent the difference in prices inside, while the small lines, known as wicks or shadows, relate to the high and low prices for that period.

Color and Meaning: What Does It Mean?

It can be hollow or filled, depending on whether the body of the candlestick closed higher or lower than it opened.

- Bullish Candlestick: In such a case, the price closed higher than the open, and most of the time, the body would be colored green or black, depending on the platform.

- Bearish Candlestick: The price closed lower than the open, and in most cases, the color of the body would be red or white.

Most charting platforms today allow traders to customize this color scheme at their discretion. However, green and red are the most used colors today.

The Wicks: A Window into Market Rejection

The candle wicks range within the given time range, showing high and low points. A candlestick with a long wick above or below the body points toward heavy price rejection in that direction; this simply means that the market really did strive to push prices higher or lower and finally failed. A small wick means the market was relatively stable, with little fluctuation during that period.

Unveiling the Power of Candlesticks in Trading

A lot more than pretty pictures, candlestick charts are a powerful way to comprehend price action and predict possible trends and reversals. One of the major reasons traders use candlesticks is the power of being able to visualize price action fast and being able to pinpoint trends.

The traditional interpretation could be demonstrated in the following: for instance, a long body-usually red or green-is normally indicative of the market making an upward, strong move in a particular direction; while small bodies or candlesticks with long wicks are quite indicative of indecision in the market or even a reversal in the works. Candlestick patterns can be useful in identifying the turning points in the market, therefore allowing traders to see what is likely to occur with the prices in the future.

Major Candlestick Patterns to Identify

Apart from what one candlestick means, traders look for patterns of the candlesticks that may lead to the reversal or continuation of the market. Such candlestick patterns are many in variation from simple to complex and have been developed to measure the attitude of the market in order to make predictions for future price behavior.

For instance, the Doji candlestick would bring indecision to the market, with similar opens and closes, and probably a trend reversal. A Shooting Star pattern, formed when a small body and a long upper wick form, could indicate that an uptrend is near its point of reversal, which it would do to head downwards.

You will learn quite a bit about the way the markets work, and improve on your trade decision accuracy, if you will study how to identify such formations.

Important Do’s and Don’ts of Using Candlesticks

While candlesticks contain volumes of information, they too are not foolproof. Traders must be careful and not base trading decisions on any one indicator or candlestick pattern in isolation from others.

- It is absolutely important that candlestick analysis be combined with other technical tools: support and resistance levels, moving averages and volume analysis.

- Wait for the candle to close: Most of the beginners are suffering from a common mistake; that is, they get into the trade when the candle hasn’t actually closed. You actually have to wait until the candle closes completely before making a move, since even within minutes the market conditions can change.

- Wait for Confirmation: Often, one candlestick pattern may not be enough to take action as a reversal or continuation. You really need to wait for confirmation from subsequent candlesticks or other technical indicators.

- Not to Rely on One Candlestick: The meaning of the candlestick formations should be in perspective with the broader trend. A bullish candlestick that occurs in an uptrend is much more important than the same candlestick formation occurring in a downtrend.

- Know Market Psychology: Candlesticks are one of the best ways to frame the psychology of the market, but one must not forget overall market conditions, news events, and other technical analysis tools.

Final Thoughts

It is among the best arms in a trader’s arsenal, as it allows for the easy, visual identification of price action, including the trend reversals, and it is great for gauging market sentiment in real time. By the time you master candlestick patterns, learn how to read them in context with the greater market, you will be much better prepared for going into an informed trade.

It is important to keep in mind that as powerful as candlestick charts are, they compose only one piece of the big puzzle. Most likely, you will want to combine your candlestick analysis with other technical analysis tools, along with some fundamental analysis, in order to develop a trading strategy that will best tilt the chances of success in the markets in your favor.

Stay tuned, as we go in-depth into the details of various specific candlestick patterns, from Doji and Shooting Star to many others-in our next episode. We will be presenting lots of different patterns you can use to enhance your trading.

And for more updates on other forthcoming videos, don’t forget to subscribe to BullRush Academy Youtube Channel. For now, happy trading!

Comments are closed.