Nick’s Forex Price Action Strategy

Welcome to the latest edition of my Forex trading strategy. My Forex trading strategy is based entirely on price action, no indicators, no confusing techniques, just pure price.

I have been developing, tweaking, and improving my price action strategy since 2005. This trading strategy is ten years in the making; it has survived major changes in market conditions, high volatility periods, low volatility periods and everything else the Forex market has thrown at it.

And that is the beauty of trading a price action strategy…

… Indicator based strategies are locked to the market conditions they were created for. Price action is fluid, it easily adapts to changing conditions, to different pairs, to different time frames and even to different traders. Most importantly, price action allows you to keep your trading simple.

Keeping Your Trading Simple

The key principle of my Forex trading strategy is to keep trading simple. I am against over complicating trading. Because the simpler your strategy is, the more effective you will be as a trader.

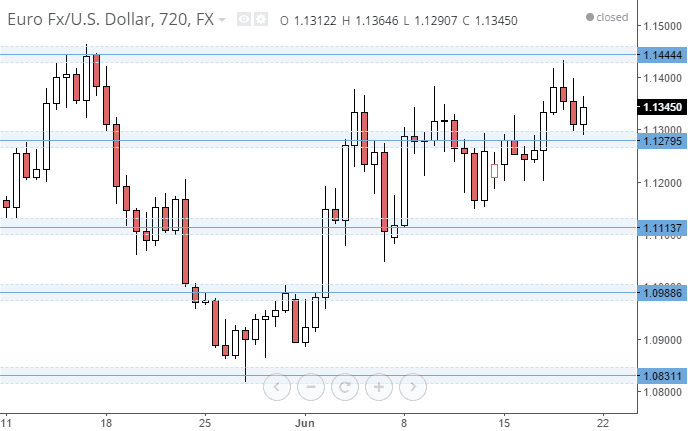

One of the main goals of my price action strategy is to keep my charts clean. The only thing I place on my charts are support and resistance areas. I use these support and resistance areas in conjunction with candlestick analysis to trade Forex. Packing my charts full of indicators would make it impossible for me to read price action.

Trading with no indicators makes my Forex trading strategy simple, stress free and highly effective. What does a clean Forex chart look like? Here’s a picture of my EUR/USD 4hr chart.

This chart is clear and easy to understand, there is nothing that distracts you from reading price. This is why I love my Forex trading strategy.

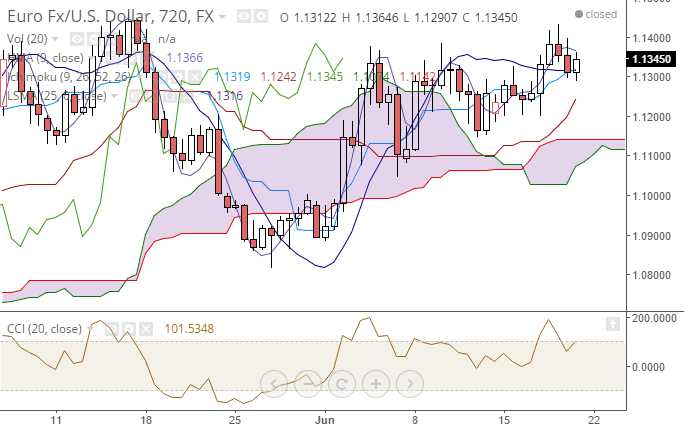

Some trading strategies are an absolute mess of indicators. Check out the image below, some people actually trade like that!

Why would you want to trade like this?

Indicators Required for this Trading Strategy

So to trade my Forex Trading Strategy I use no indicators.

I generally don’t like using Forex indicators, as I find the data worthless, as they lag current price. If you want to be in the moment and take trades based on what’s happening right now then you have to base trades on current Price Action.

Which Currency Pairs can you Trade Successfully using Forex Price Action?

My Forex Trading Strategy will work on any currency pair, which is free floating and regularly traded.

This is because my method is based on Price Action. This means you can use this trading strategy to successfully trade any currency pair you find on your Forex trading platform.

That being said, I personally prefer to concentrate on just a few currency pairs at any one time. I find it too distracting to try and keep track of too many pairs at once.

I mainly trade the EUR/USD, USD/CAD and AUD/USD. I generally trade these currency pairs as they are the most predictable and their movement is smoother. You don’t find random jumps unless there’s been some highly unexpected news, which is pretty rare.

If you prefer to trade a particular Forex session such as the London, New York and Asian session then choose the main currency pairs that are active at those times.

Price Action Trading Works Better on Longer Time Frames

Since this Forex Trading System is based on Price Action you can trade any time frame from one hour and above.

I mainly concentrate on the one hour, four hour and daily charts. These are consistently the most profitable, as the patterns are easier to spot and lead to more consistent profits.

Types of Price Action Analysis

Primarily, I use two forms of Price Action Analysis:

- Support and Resistance lines.

- Candlestick analysis.

How to Enter Trades using My Forex Trading Strategy

Due to the recent economic uncertainty and countries losing their credit ratings etc, currencies aren’t trading as they normally would. This has led to me to trade reversals exclusively.

I look for strong reversal setups forming on top of my Support and Resistance areas. Once a pattern forms, that indicates a reversal, I set up a trigger price and enter the trade. I take several trades each week.

Trading Strategy Targets and Stops

Targets: My targets are on average 80 pips.

Stops: My stops are on average 40 pips.

These targets and stops differ during different market conditions. I usually allow price action to determine my target and stop. This means I will read the candles and set my stop based on recent highs and lows. A common place for a stop will be above or below the most recent high or low.

How to Adjust the Trading Strategy Around News Releases

I use the Forex Calendar from forexfactory.com to keep track of economic data. Statistically I have found that I do not need to avoid trading during high impact news releases. In fact, by trading through most news releases, I end up making more profit…

… Why is this?

Banks and other large trading institutions pay millions for analysts and data feeds; this allows them to make educated guess about upcoming economic data releases. These guesses are factored into price before the data is released.

If a trade set up forms before a major economic data release, it can be a sign that large institutions are position themselves for the release. If price action is telling you to short, there is usually a reason!

The only news I avoid is unpredictable news or very high impact news, here is a quick list:

- Speeches by central bank leaders or politicians.

- Interest rate announcements or anything directly related to interest rates.

- NFP report, the name changed a while ago to the “Non-farm employment change” report..

You should also watch out for important political meetings like the G7 and G8 summits. The recent G7 summit in June 2015 caused a lot of unpredictable moves in the Euro.

For the most part, news can be safely ignored. The only thing I do not do is enter a trade that is triggered by a news release. News based moves tend to retrace quickly, so if I have an entry trigger, I remove it before any major news release.

As you can see, my Forex Trading Strategy is straightforward and will allow you to make pips in any market conditions, with almost any Forex currency pair.