The other day I held a webinar about trading Forex on large time frames. Below you will find the webinar along with a lot of other information on large time frame trading.

High-maintenance trading SUCKS. It is always stressful, and it makes people – AND ME – feel uncomfortable, nervous, and rushed.

How can you learn to trade, or even trade comfortably, when trading is stressful and your charts require almost constant supervision?

You can’t.

That’s why I prefer a low-maintenance approach to trading. And that is why I trade large time frame charts:

How to Trade Forex Low-Maintenance (while still making consistent profits)

Before you keep reading this article, and before you commit to watching the six hours of videos below, you need to ask yourself a question.

…Why should I trade low-maintenance and do I really want to?

Low-maintenance trading is for people who DON’T want to – or can’t – spend several hours per day monitoring their charts.

My trading strategy is designed so that you can trade effectively with as little as thirty minutes per day chart-time.

Thirty minutes… how is that possible?

That’s where large time frames come in.

When I say “large time frame charts”, I mean four hour, six hour, eight hour, twelve hour, and daily charts. Trading these time frames allows you to split your day up into two to three parts.

Splitting up your trading day

On five minute charts, trades can form, trigger, and be over in just in ten minutes. Which means you need to monitor your charts almost constantly.

And you need to rush into trades.

On eight hour charts trades unfold in slow-motion. It takes a minimum of sixteen hours for a trade to form, trigger, and hit its target.

For you, this means that you can fit trading around your life.

You only need to check your charts three times per day to catch trades that form on the eight hour chart.

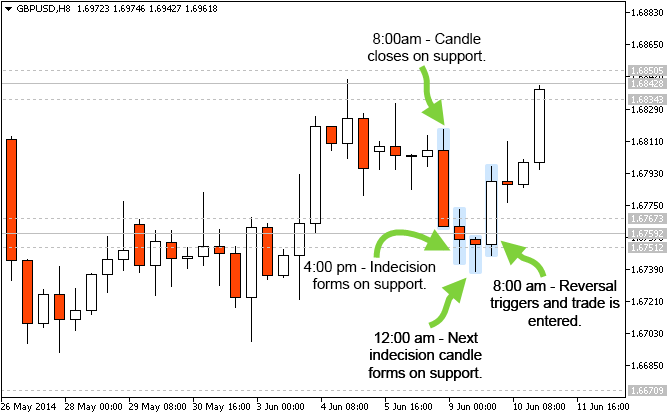

The chart above shows a recent trade using my price action strategy on the eight hour GPB/USD chart.

This trade could have been spotted, and taken, even if you only checked your charts a few minutes every eight hours.

- 8:00 am – You check your chart and you see a strong bearish candle heading into support.

- 4:00 pm – You check your chart and see indecision forming. You know price may reverse so you set an entry order, a stop, and a target.

- 12:00 am – You check again and you see a second indecision candle has closed. You pull your entry order down and adjust your stop and target.

- 8:00 am – You check your chart and your first target is hit or almost hit.

Not all trades play out this simply. However, you can see that at no time where you rushed into the trade. You had around sixteen hours to plan this trade.

This is low-maintenance Forex trading.

The video below is a recording of my recent webinar. In the webinar I show you several other recent low-maintenance trade examples. I also answer a lot of questions about my strategy.

My Price Action Forex Trading Strategy

Now that you understand low-maintenance trading, you need to learn how to trade price action in Forex.

In March 2014 I held three webinars over the course of three days. In the webinars I covered my price action trading strategy in great detail.

Price Action Strategy – Candlestick Analysis

The first step to learning price action in Forex is candlestick analysis. This is nothing like that basic list of candlestick patterns you have probably seen on hundreds of websites. In the webinar below I teach you advanced candlestick analysis.

Price Action Strategy – Support and Resistance Areas

The next step to learning price action is support and resistance. In the webinar I show you how I identify and place support and resistance areas. This way you can know ahead of time where buyers and sellers will enter the market.

Now that you know how to place support and resistance, go and place them. After you do that, compare your areas to my support and resistance areas.

Price Action Strategy – Trading Reversals

The final step in learning price action is learning to use candlestick analysis and support and resistance together to take reversal trades. In the webinar below I show you how I trade reversals.

What do you think of low-maintenance trading?

I hope you enjoyed this post!

When you finish the content, leave a comment, and tell me what you think about this post.

Also, feel free to ask me any questions you have if you need clarification on something.

I will respond to every comment.

Comments are closed.