Want to become a profitable trader in 2024? Want to find the best Trading Setups?

Look no further. BullRush Academy has many different trading setups. Most of them focus around price action though.

So read on to learn what the best price action trading setups are for 2024, and how you can trade them even if you are short on time!

Game Plan

Every year most traders layout a game plan for the coming 12 months so that they have a clear set of goals that they can work towards.

It is important to have concrete goals. It gives you something tangible to work towards and that direction serves to progress your trading, instead of going in circles encountering the same problems, just on different days.

So – what does a good game plan look like for 2024?

- Assess expected market conditions.

- Plan on how to trade in those conditions.

- Execute that plan.

Simple yet effective. Let’s break down each step and take a closer look at what exactly each point entails…

Market Conditions

2019 was a year defined by heavy ranges and low volatility.

Fear was apparent throughout the year for a number of reasons that had a direct impact on the forex market’s conditions.

The U.S. – China trade war sparked concern and an uncertain atmosphere around the two nations relations which was mirrored in currency pairs. We also saw the continuing impact of Brexit on GBP and EUR pairs that undoubtedly impacted the market consistently, with spikes occurring regularly throughout the year.

On top of that, we have also seen new highs and new lows across a lot of pairs that by itself causes uncertainty. But before we go into volatility and why I think it will return, let’s look at some juicy statistics.

Average Daily Range (ADR)

ADR is useful for traders when you want to assess market conditions for past, present, and future forecasts.

What is it though?

Well, the daily range is the difference between the highest and lowest points that price reached in a day. The ADR for one year is every day’s range for the year averaged.

So you can see that ADR is a way for us to visualize market volatility over an entire year – this informs us in an important way that helps us tailor our trading approach to the market conditions.

This is why we love Price Action trading strategy – it is flexible and can be used in pretty much all market conditions!

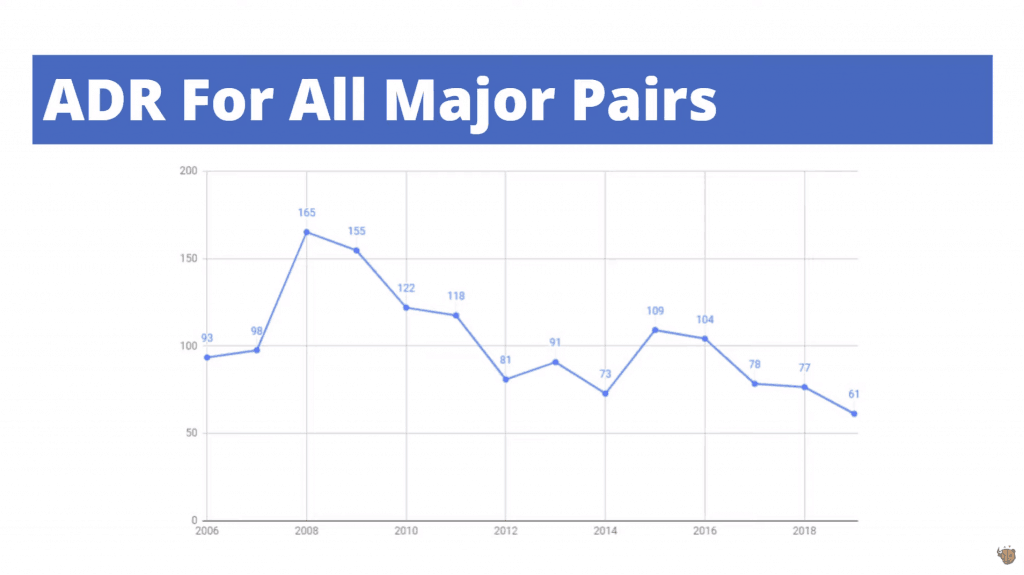

Check out the ADR we calculated from 2006 below:

ADR has been on the lower side for the previous 3 years which means market volatility is low at the moment. Previous low volatile periods were from 2012-2014 and 2004-2006 (the latter not shown in the image).

These periods lasted for 3 years each.

This factor, combined with the resolution of the trade war and Brexit, leads me to the conclusion that 2020 will see an increase in volatility, requiring an adjustment in our trading approach from previous years.

Depending on your style, you may not prefer this though. Higher volatility means there are more spikes in price and price is therefore much less predictable – something that risk averse traders will not fancy.

However, higher volatility does give a few benefits.

You usually hit your targets much quicker, freeing up your margin for the next trade ultimately resulting in more trades which, if you are trading well, means more profits!

This is why here at BullRush Academy always stress the importance of preparing for the year ahead. It means you can adjust to the pros and cons of the market and take advantage of it so you make the most profit.

Significant Lows

The other market condition that is worth noting is that a lot of the major pairs are seeing some significant lows being hit.

When there is consolidation of lows across multiple pairs, that usually signals that there will be a turn around.

Nevertheless, predicting the end of a major trend carries some risk so you should not assume that they are over.

Yet, the possibility is still there that we could see some pretty massive bullish pushes on a lot of the major pairs this year, trends that will be extremely lucrative if you can ride them.

At the end of the day, you can never be certain so you need to keep your eyes on the chart, note down significant levels that you want to be notified when broken, and be prepared to take some longer term trend trades.

If you prepare well, you can catch them and generate some serious profit.

So, we have an idea of what to expect now that we have identified the market conditions for the coming year – how do we plan on trading in these conditions?

2024 Trading Plan

How we plan on trading these conditions can be broken down into 5 major points:

- Trend heavy market so focus on trades that follow the major trends.

- Trending pairs inevitably have periods of ranging – do not neglect range setups when they show themselves as they are the most reliable, profitable setups in your arsenal.

- Outlook for increased volatility means counter-trend trading should be approached with caution. Less emphasis on counter-trend trades than last year required.

- Medium to high volatility means our targets will get hit quicker this year. Practicing and implementing target extension methods are vital to increasing our profitability on good trades.

- Politically things have calmed down – major events are the on-going Coronavirus epidemic and upcoming U.S. election later in the year. These need to be kept in mind when trading.

These conditions should be placed in your trading plan if you have one, or in a document you look at frequently. Do not underestimate the impact simply being aware of these conditions can have.

Alright – we know the conditions, how about the setups that we are going to use to execute our plan?

Three Best Forex Trading Setups in 2024

We won’t go into detail on each of these setups in this article – instead we will link you to the appropriate time in the video as that will be a much more effective method for you to learn how to trade these setups.

Continuations

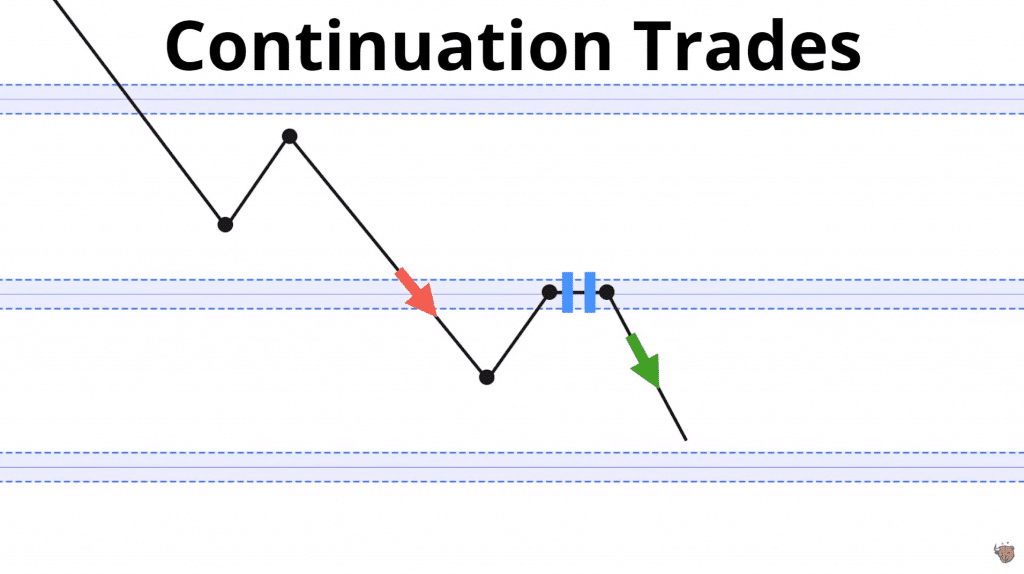

Our first and most important tool for trading in these market conditions are continuation trades.

These are setups that go with the major trend and take advantage of strong runs. They are perfect for target extension and are often quick to reach targets.

You will need to practice entries and target extension specifically with these setups so don’t waste time and hop on a demo account to do just that.

We go over these in depth from 32:32 in the webinar.

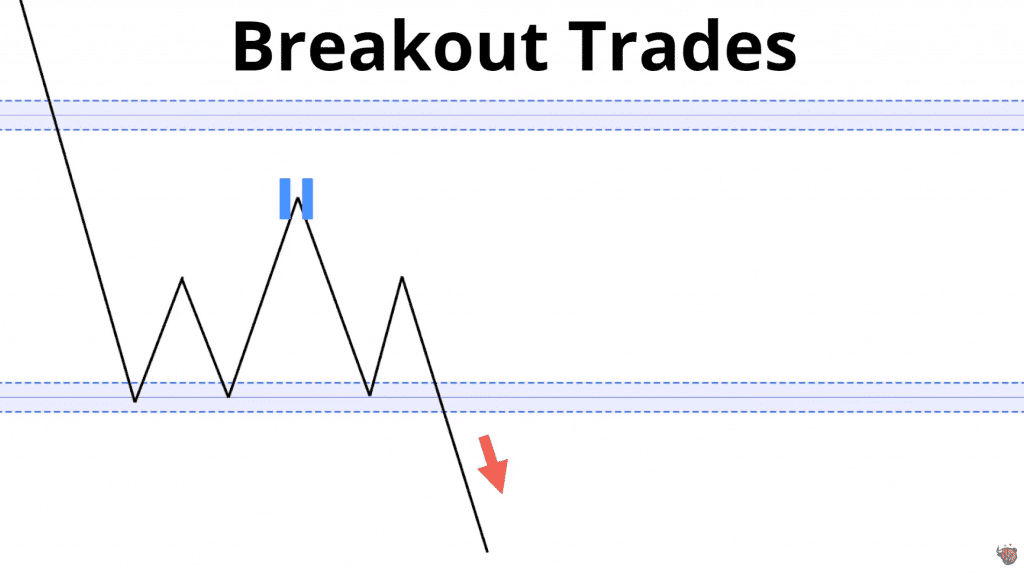

Breakouts

This setup is a little bit niche and hasn’t received as much focus in the past. However, they are popping up more frequently at the moment and can get you a great run of profit.

There are a few ways to approach these in regards to rules for entry among some other parameters.

Counter-Trend Reversal

These trading setups take advantage of pulbacks within a trend.

Price will rarely move in a single direction without resistance from the opposing bulls/bears. A natural property of trends is that there will be pull backs.

In order to take advantage of this, you should look toward lower time frames. These will be quick execution trades that you don’t want to extend targets on as they will often continue with the major trend.

So be aware of your targets, don’t get greedy, and don’t force a trade where there isn’t one.

And there you have it – forex trading for the 2024 year, its market conditions, a plan to execute on and setups to focus on.

Ultimately, you need to be flexible to market conditions as they unravel so whilst this plan can serve as a guideline, you still need to exercise some adaptability to what you see.

Afterall, the power of Price Action trading is its flexibility and adaptability, something that you should always be aware of and use to its fullest.

The coming year looks to be an exciting one for forex trading and I personally am pretty excited for it. If you have any questions, comments, suggestions, please feel free to leave me a message in the comments below and I will respond to all of you.

Thanks once again to those of you that attended live, and I’ll see you at the next one!

Comments are closed.