When learning Forex, people don’t tend to learn the nitty-gritty details of trading.

Things like what happened with last weeks EUR/CAD long.

What happens when you enter a trade, and it doesn’t go in your direction? Instead, price starts ranging, getting excruciatingly close to your target, and then falling away…

…If you have been trading for a while, you know the kind of trade I am talking about. If not, take a look below.

Here are two trades we took last week in the advanced course forum.

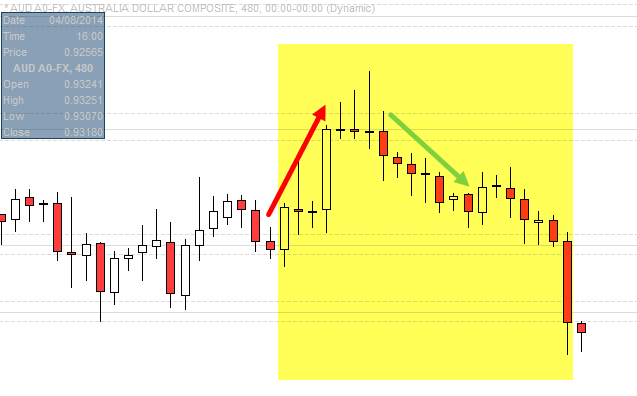

First, is an AUD/USD short.

This trade hits it’s first target without much hassle. There were a point at which price slowed down a little. However, the lower lows and lower highs were consistent, and sellers had control the whole way down to the first target at 0.9400.

This trade did not manage to hit the second target by the end of the week, so some people closed it out. Others kept this trade open and if you look at you chart today, you will see this trade is now close to 100 pips in profit.

So, while it was not the perfect trade, it was profitable. The thing to note is how well sellers controlled price.

Now, let’s take a look at the next trade…

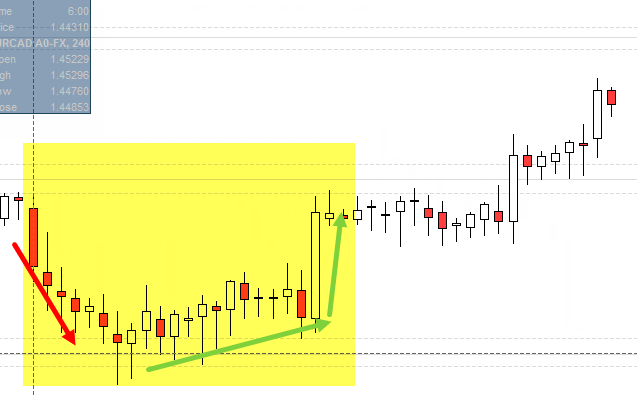

… This is the EUR/CAD long trade we took last week.

This one is not nearly as good looking. After my entry, things got messy. Price ranged for days, my first target was almost hit twice, before finally being hot on the third attempt. It looked like buyers simply weren’t controlling price.

A lot of people jumped out of this trade early. Some of us stuck with this trade, which as a good move, because the trade paid off in the end.

And that is what I am going to show you in the video below. I will play back this trade and explain exactly why I stayed in.

Like I said at the start of this post. When you start learning Forex, you do not learn this kind of stuff. So hopefully this video will help you understand when to stick with your trade.

Check out My Price Action Techniques for Managing Trades

My free Forex Price Action strategy. Bookmark this link because I will be updating it with lots of new content very soon.

If you enjoyed this video, or have any questions, please leave a comment below. I reply to every comment.

Comments are closed.