We are in the middle of something unprecedented.

Global markets in every sector are experiencing volatile conditions that have occurred overnight due to the spread of Coronavirus around the world.

Usually, it takes a few months for the volatility from a recession to build. That is not the case with the current crisis we are facing.

We have gone from a relatively healthy global economy to a recession within two weeks. This inevitably affects everyone, and in regards to trading it fundamentally changes our approach to the market.

So if you want to know how to adapt your strategy and make this recession one where you actually earn some money from your trading, read on to find out exactly how.

Adapting My Price Action Strategy

Many forex trading strategies will have become obsolete overnight due to Coronavirus. Fortunately, that isn’t the case for price action-based strategies.

Price action is flexible. It adapts very well to different market conditions.

Nevertheless, I have had to adjust my strategy to one that is able to take advantage of these markets.

In fact, this is a strategy I used in 2008 that was incidentally my most profitable year.

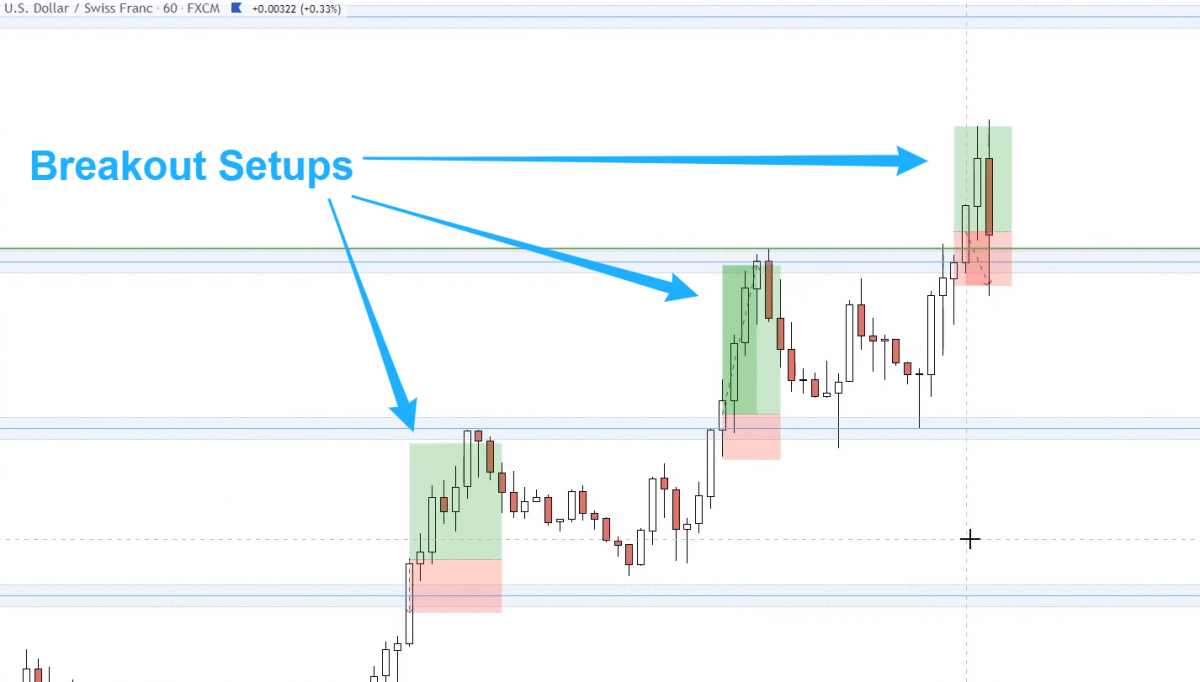

Back then, I was using Breakout setups regularly and finding incredible success with it. By 2010, volatility had died down again and the setup lost some of its effectiveness.

This strategy is not untested – quite the opposite. I traded with breakouts for two years straight so I am really excited to bring the setup back into my trading arsenal and show you how powerful it is as a setup.

I have told my students about the upcoming year and I will repeat it here too…

This is going to be the best year of trading we see for the next decade at least. So now is the time to dig your feet in and get on your charts.

Breakout trading has been seeing some incredible results in the Forex4noobs live trading chat room and I can confidently say that this is the best setup to trade with my strategy right now.

I have adjusted my approach to priorities breakout setups – I still keep an eye on the larger time frames but there are simply too many great setups on the lower time frames to ignore them.

What to Expect For the Next Year

Some traders think this will blow over, but I disagree.

The last recession affected the markets for two years and Coronavirus could very well have a similar effect on the market.

Regardless of how you think the markets will progress, it would be silly not to adjust to what is in front of you right now, especially with the success we are seeing in recent breakout trades.

So what will the next year look like on the forex charts?

Well, volatile markets typically have two stages that they progress through. Understanding which stage the market is currently in will have a direct impact on your trading, so it’s crucial to assess which stage the market is in.

Typically, you will see pairs trending strongly for a few days or even a week or so of trading, followed by days or sometimes weeks of consolidation.

Consolidation is when there is a correction and a restabilising of price. For instance, if there are heavy bullish trends, you can expect to see an eventual retrace followed by more stability. Uncertainty in the markets causes a lot of this volatility and lack of stability.

Now, it is important to note that this is not a strict pattern that price follows. You could very well have a trend followed by another trend across all pairs.

These trends are great to trade and is where we get the most opportunities for amazing trades

Fortunately, even if a pair is in a period of consolidation, it still sees a lot of price movement. In a regular market, this period of consolidation would be defined as a trend in most cases. So look for trades even during this phase!

I focus on range trading and reversals during consolidation periods – I won’t go into details on those as I have done so in the past and I want to keep the focus on breakout setups.

You will also see some slow days where almost nothing happens…

These will be sporadic and the thing you need to watch out for in this period is to not force trades where there are none. That is a general rule I have consistently told you guys anyway, so really there is no change in that regard.

Alright, so we know what to expect from the markets – let’s take a look at the setup that is going to make us a lot of gains in heavily trending markets!

How to Trade Volatile Markets With Breakout Setups

The foundation of breakout setups is trading with the trend and taking advantage of the momentum that price has in this phase.

Essentially, you are looking for price to break support or resistance, in the direction of the trend, and ride the momentum that price will gain by breaking these areas.

As with my normal strategy, support and resistance form a vital part of the trading process. Since we are on lower time frames, we need to adjust our approach slightly.

I have found that using the 1 hour to place support and resistance is the most effective time frame to use for placing your SR. This lets you see both major and minor support and resistance areas.

Looking for significant highs or lows forms the basis of our entry into trades. I use a green horizontal line to indicate the level I want to see broken, like in the image below.

To calculate the entry, I get ten percent of the pips made in the previous 3 candles and add that above the significant high that is the green level. You don’t wait for a close on the candle that breaks the significant barrier.

So if the 3 candles before price broke the green level gained 50 pips, I will place my entry 5 pips above the green level since that is 10% of 50.

If you want more confirmation that price has broken the support or resistance area, simply increase the pips for your entry – that could be 20% (10 pips) or any amount you want.

To place your stop loss, you place it below the support or resistance area that has been broken. There is no exact definition to placing the stop loss other than placing it below the significant high/low and the SR area.

Usually we would place the stop loss at the low of the previous candles but this is not the most efficient way for Breakouts.

To place your target, place it before the next area of support/resistance at a minimum of 1:2 risk-to-reward ratio. If price is pushing strongly, look to extend your target.

Part of your process should be figuring out when you are happy to move your stop loss to break even, so experiment a bit with this and what you are happy with.

And there you have it!

Trading breakouts is going to be lucrative in these market conditions if you dedicate the time to trading. If you have some spare time during isolation I strongly recommend trying out some lower time frame trading!

This can be applied to the daily charts as well, but for the moment we need to wait for price to establish new SR areas which will take another week or two.

Feel free to leave any comments or questions you have below!

Comments are closed.