Every independent trader wants to make money from forex trading, and trade forex for a living. However, it is surprisingly difficult to get an honest answer from industry professionals on exactly how you can go about making a living from forex trading.

In my recent live training session I cut away the fantasy trading and give you the reality of how you can make this happen.

Having unrealistic goals that are really just a fantasy is a massive issue in the forex industry.

You will never be able to achieve any of the goals and find yourself feeling defeated and stop trading. But if you have realistic goals and expectations you can actually achieve, confidence and success can create momentum in your trading which will push you forward to your goal to trade forex for a living.

So let’s do away with the fantasy, the bull, and the lies. Let’s see what the real requirements of trading forex for a living are so that you can put yourself on a path to success.

- Want to know how to trade for a living?

- What are the actual risks you will face?

- What do you need to do to prepare?

- How can you generate multiple streams of income?

Read on to get the answers to all of these questions and more!

Fantasy Vs. Reality

It can be really difficult to separate fantasy from reality when it comes to forex trading. A lot of influencers will show you Lamborghini’s and a chart saying how they have made millions in a month and how you can do just the same.

The reality, however, is not this. Maybe this person is an outlier and found huge success with their trading.

But the majority of traders will start with lower capital and have a much different journey.

You can’t skip to the end where you are making hundreds of thousands of dollars unless you have the capital to do so. The more money you have in trading, the more you make.

I am going to go through some of the most common fantasies of forex trading and show you the reality so that you can make tangible progress.

1. I want to make $5,000 every month.

This is one I see frequently with new members of my course. It makes sense too – earning profit every month is an understandable desire. Regular jobs you get paid every month, why should forex trading be different? Well, the reality is different. You are going to see some months of losses because you can’t win every trade. Statistically, you will have a losing streak and that will impact your profit. So don’t be surprised if you can’t achieve profits every month because it’s completely normal!

2. I want consistent profit.

Related to our first fantasy, consistency in your profits is another common goal that new traders have. There are different tiers to this which make this a mix of reality and fantasy. If you want consistent weekly profits, that is a fantasy, plain and simple. Consistent monthly profits are unlikely, especially if you are new to trading. However, consistent yearly profit is a much more realistic goal to achieve. This is where having a long-term mindset for forex trading is going to be a huge advantage for you!

3. I want to grow $1,000 to $100,000 fast.

Many traders start out with a small amount of capital and want to grow their account quickly. This can be a slippery slope though. If you are working on growing your account and want to do it fast, there is immediate pressure to succeed. This can lead to big problems like Fear of Missing Out (FOMO), greed, chasing trades which inevitably prevent your account from growing. Furthermore, what you put in is what you get out. If you are trading for 3 hours a week, it’s just not realistic to expect huge profits. The more time you dedicate to your trading, the quicker your progress and learning will be.

4. I want an automated trading bot to make me money whilst I sleep.

Look, there are some great trading EA’s out there that can help you with your trading. But trading cannot be fully automated yet and to have the expectation that a bot will make you a lot of money is a fantasy. Banks and hedge funds have some bots but they have millions of dollars behind them. You won’t have access to anything that well-developed. It is simply on a whole other level.

5. I want to rely on forex for my income.

This is the most common goal that traders have and the one that is sold the most to new traders. While you can find financial independence through your trading, there is a mix of reality and fantasy in this goal. What happens if you become sick or injured and can’t trade? You can’t rely on your forex trading in that scenario. Do you have an emergency fund setup, or insurance? The reality with this is that being a forex trader means being self-employed. As someone who has been self-employed for over 15 years, the most important lesson I have learned is that you need multiple streams of income to protect yourself and to increase your wealth. So while you can generate a living with forex trading, relying solely on it is not realistic nor is it smart to do.

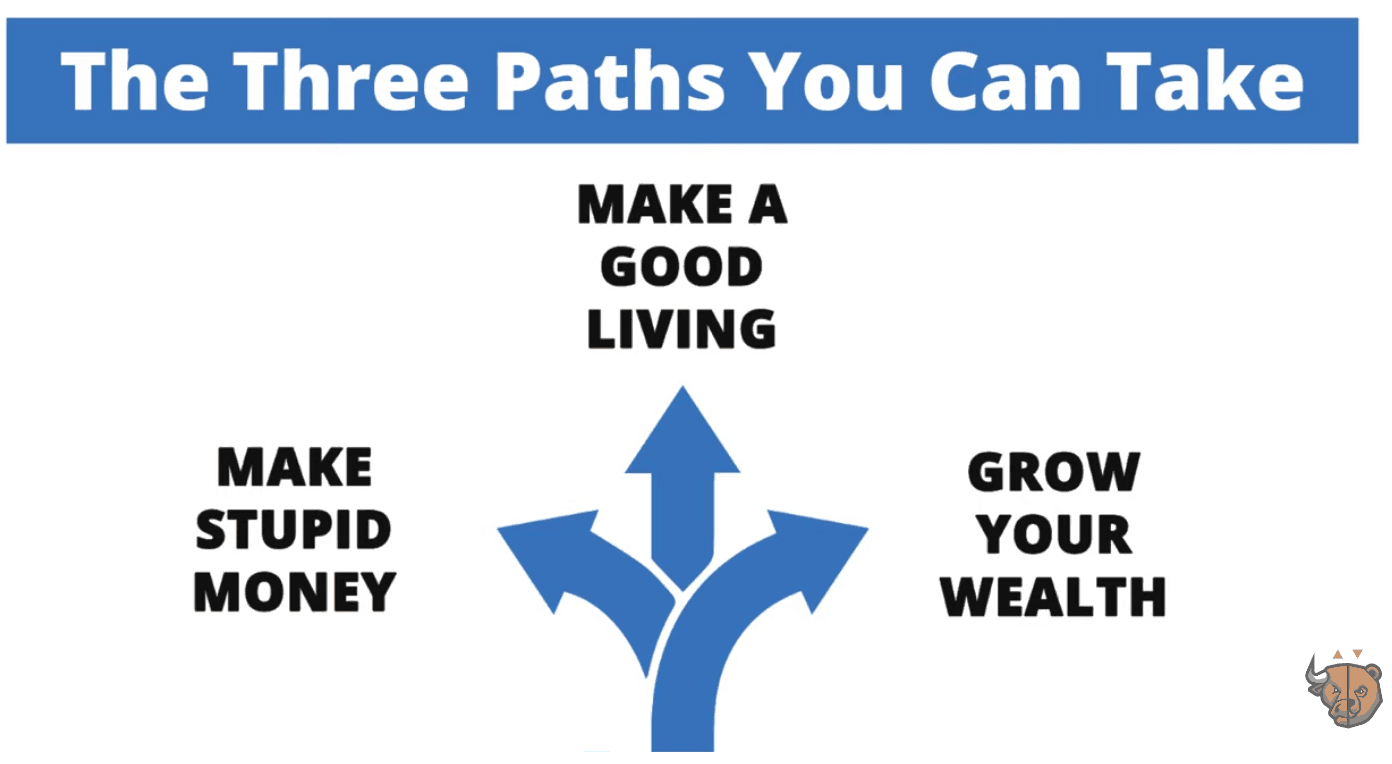

The Three Paths in Forex

In forex trading there are three broad paths you can choose from when it comes to what you want your trading career to be:

- Make stupid money.

- Make a good living.

- Grow your wealth.

These options are all open to you but they impact your life in very different ways.

If you want to make stupid money from trading then you are going to need to put a crazy amount of time and effort into it. You can work for prop firms or managed funds – either way, if you want to make stupid money you will have to put in the effort.

What you put in is what you get out. This would be a high-stress lifestyle where you would dedicate a huge chunk of time toward your work.

That works for a lot of people though because the reward is a big salary.

Option number two is the route I have taken where you make a good living, can pay your bills, and be your own boss. You make a living out of forex but not to the financial heights of working for a managed fund.

If you want to make big money, trading with your own capital is not going to get you that big pay day unless you already have a lot of capital. You can earn addititional trading capital from prop trading firms or trading competition platforms.

The last option is a more relaxed approach to trading that still earns you money. You would approach trading as if it were an index fund or an investment.

Building up your wealth with steady progression and no need to make it big. This is a low stress approach that you will typically see older traders take on or traders that have another job.

You would invest your money into your trading account and trade it on the side, growing your wealth.

Each of these paths are viable choices when you look to start trading. Each path will suit different people’s needs and part of your forex journey is figuring out what trading career you want!

Preparing to Trade for a Living

So we know some of the fantasies and paths you can choose with forex – what do you actually need to do in order to start trading forex for a living though?

You are self-employed if you are trading forex for a living (unless you go for a prop firm, managed fund etc.) so you need to protect yourself.

Your first step is to create an emergency fund.

This is an amount of money that you can fall back on in case you get injured, ill, or times generally become hard.

Without an emergency fund you have no floor beneath you to land on in case of an emergency.

Your second step which supplements the first is to get income insurance. You can receive money if you become injured or ill which is another safety net for you to fall into.

These are boring but necessary if you want to seriously trade forex for a living.

Now when it comes to your trading capital you need to be smart. Do not put all the trading capital you have into your forex trading account.

Do you trust your broker more than you trust yourself?

No – of course not!

If you are trading with $100,000 it is simply not necessary to put that entire pot of money into your trading account.

Brokers have gone under in the past and lost a lot of other people’s money. Be smart, be safe, protect your capital.

The most important part of making forex a living is finding a source for multiple streams of income.

I am the most qualified to discuss this route of trading out of all the other paths because it is what I have done.

I learnt trading from a young age and turned it into my career. However, what I learnt early on is that you cannot rely on one single source of income.

You need to diversify your income.

This is related to getting injured or ill, but more importantly it is how you can create more wealth.

I created a business out of the skills I learnt through trading. I diversified my income and because of that I now generate more wealth.

You could create a business, apply for a new job, find different investment opportunities. Really, anything that generates you an income that isn’t reliant on your trading counts.

The thing with forex trading is that the more trading capital you have to trade with, the more money you make. So the key to making a living out of forex is building your capital up.

If you are solely relying on your trading to do this, it could take you a while. This is why it is difficult to trade forex for a living. Having that extra income from a different source will help accelerate your forex earnings.

Obviously your trading skills need to be good enough for you to make profits, but once you are confident in your trading you can focus on building up your capital.

Once you have built up your forex account, you can earn a very healthy amount each year without putting your capital in as much risk!

Comments are closed.