So, you want to learn how to set smart stops and targets?

Placing smart stops and targets is one of the most common issues traders face. The good news is that it’s easy to get it right with just a little bit of practice. And in this article, I am going to show you how.

Bad Stops Get Hit, Bad Targets Get Missed

Do your stops get hit often only to have price turn back around and head to your target?

Does price often get close to your targets but miss it only to turn around and head back to your entry?

It’s enough to drive you mad.

But there is usually a simple explanation, you are setting bad stops and bad targets. Bad stops get hit too easily and bad targets are too hard to hit.

There is a simple little method you can use to place smart stops and targets. Smart stops are harder for price to hit and smart targets are easier for price to hit.

I call this method STEP.

So let’s get started!

Spotting a Reversal Trade

First we are going to need a simple trade setup. This guide is intended to help traders using any trading strategy, not just my strategy.

However, I need an example trade in order to explain these concepts.

So, I will use a reversal trade which is one of my staple trade setups I share in my free price action strategy.

The STEP method works with almost any trade setup though!

If you already understand the basics of my strategy, then the trade example below will make sense to you. If you are unfamiliar with my strategy or reversal trading in general you may want to click the link above and learn about these setups first.

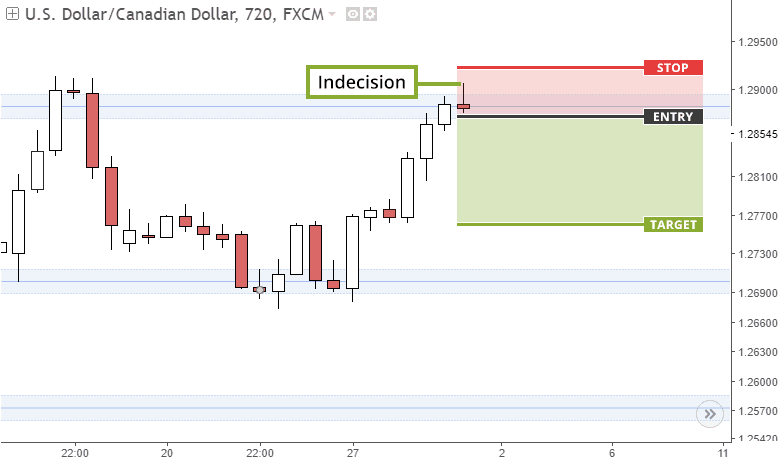

This is an example of a short reversal trade setup. We are entering short from an area of resistance after strong indecision forms. Our stop is placed above resistance and above the high of the indecision candle and our target is placed above the next support area.

Why did I place my stop and target there? Well, I used…

The S.T.E.P Method

The S.T.E.P method give you an easy to remember guide to entering trades with the perfect stop and target every time. Here is how it breaks down:

- Stop The first thing you do when you spot a potential trade is identify the safest and best stop loss. I will show you how to do this below.

- Target Next you want to figure out the perfect target. A perfect target should be easy for price to hit while still making you a good return.

- Entry Next is to pick the right entry point and make sure you have a good risk to reward ratio.

- Place When you have your stop target and entry set, you can enter the trade.

Let’s break down the S.T.E.P method step-by-step :)

Step 1: Placing a Smart Stop Loss

One of the first things I tell my students to do when placing a stop is to make sure you place it behind barriers. What is a barrier?

- Areas of support and resistance.

- Recent highs or lows.

- Psychological levels.

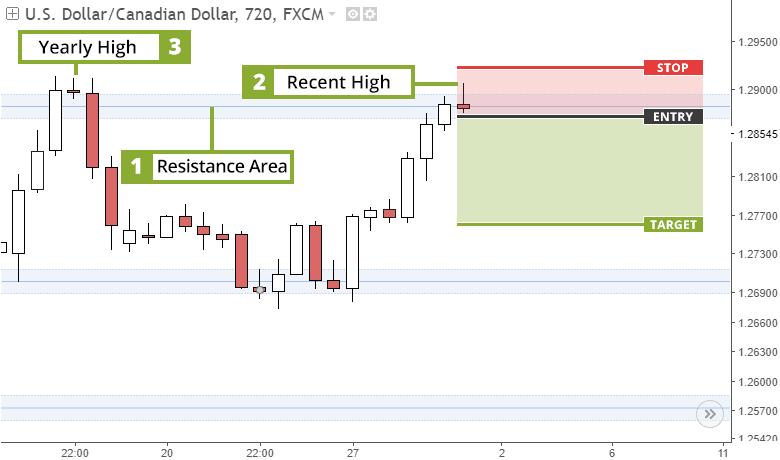

Sticking with the trade example above, let’s see why I placed my stop where I did.

Support or Resistance

We are trying to take a short trade on this USDCAD pair. The first thing to notice when looking for a stop on a short trade is where resistance area is (marked with a 1). We are going to utilize the resistance area in order to get a safe stop loss placement!

When trying to set your stop loss, having it above the resistance (or below support for a long trade) is going to give you great advantages for your trades.

Retraces are quite common after entering a trade, even retraces that go beyond your entry point.

Most traders know the pain of a trade being stopped out due to a retrace, only for price to then push in favor of your initial prediction.

Placing your stop loss above resistance means it is less likely to be hit by a retrace.

Why?

Well resistance acts as a barrier for price and retraces are usually weak moves. Weak moves tend to fail when they hit barriers, so setting your stop behind a barrier is critical!

Recent Highs or Lows

In addition to placing the stop above resistance, we want to place it above recent highs (or below recent lows for a long trade). When bulls are losing control of price, making new highs is harder, so placing our stop above recent high provides extra protection (marked 2 on the image above).

You must be aware that, especially as a new trader, you will subconsciously want to give yourself a tighter SL.

This is normal; it’s because a tighter SL could mean a better risk to reward ratio for you. But trading is about risk management. You need to give your trades enough space so that you allow price to move without losing you a trade.

Successful trades often experience a retrace.

So placing your stops above recent highs for short trades and below recent lows for a long trade provides a bit of extra protection.

Psychological Levels

Psychological levels are an additional barrier that you can sometimes use for stop loss placement. Psychological levels can be things such as yearly highs or lows or large rounded numbers like 1.0000 on USD/CAD for.

These levels are significant because they act as psychological barriers. The market is driven by people and people react to psychological levels.

In the image above we placed our stop above the yearly high (marked 3) as we expect the year high to act as a psychological barrier, making our stop safer.

The key to a good stop is placing it behind as many barriers as possible.

Step 2: Setting the Perfect Target

The key to placing a good target is summed up in four little words, remember them because they are important…

Look to the left.

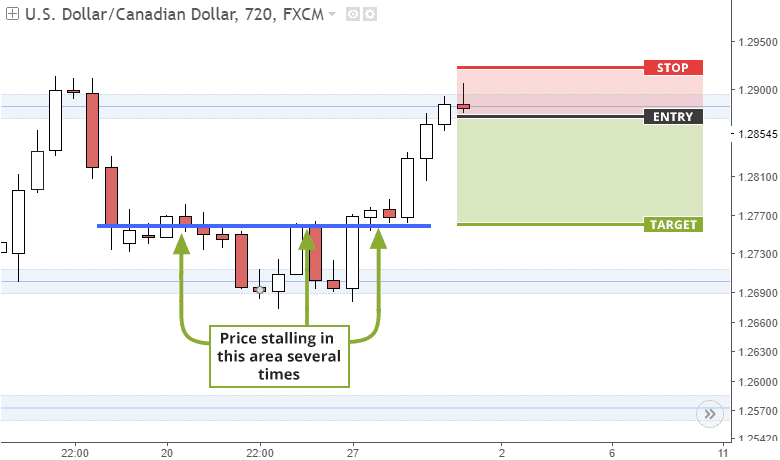

When you are looking for a target the first thing you do is look to the left for recent points at which price has stalled.

In the image above the potential trade is shown by the trade tool (the green and red thing).

Why is the target placed where it is?

Well, to the left you see price stalled around the area marked by the blue line three times in the last few weeks. This area represents minor resistance and is therefore a barrier. We want to make sure our target is placed before or at barriers.

Stops go behind barriers and targets go in front of barriers!

This is one of the simplest types of targets you can have. There are way more advanced targets and ways to extend your targets beyond barriers. However, if you are new to trading stick to the basics and put your target ahead of barriers!

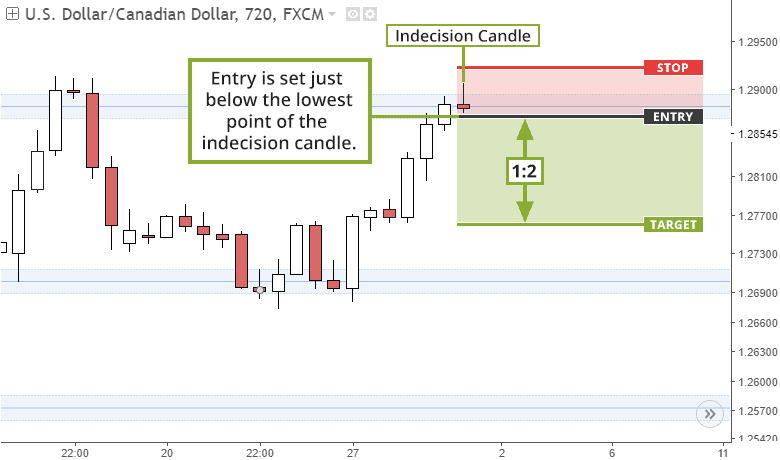

Step 3: Find an Entry (Risk to Reward Ratio)

Finding a good entry is relatively simple because a good entry only needs to meet two criteria.

- The entry is in line with your trading strategies entry rules.

- You have a good risk to reward ratio.

If you do not know what a risk to reward ratio is, it’s simply the ratio of your stop loss and target. So if your stop loss is 50 pips and your target is 100 pips your risk to reward ratio will be 50:100, which is simplified down to 1:2.

I won’t go into too much detail here as both of these points will differ from strategy to strategy.

For the example we have used so far in this article, the entry is placed just below the lowest point of the indecision candle. This is the most basic type of entry I use because it is effective, it gets you in at a good price and it often gives you a great risk to reward ratio.

The risk to reward ratio for this setup is 1:2 which means my target is twice the size of my stop loss. The lowest risk to reward ratio I use is 1:1.5 on any trade. However, I always aim for 1:2 or more where possible.

There are more advanced entries I use like retrace entries and trend entries but I won’t go into those here.

Step 4: Place The Trade

This is the easy part. Once you have your stop, target, and entry prices all you need to do is place the trade. If you followed the first three steps correctly you should have a safe trade with an easy to hit target and a hard to hit stop.

Has This Helped?

Do you think the S.T.E.P method will help you with your trading?

Leave a comment below and let me know!

Comments are closed.