I started off the month of March by holding a live trading session on placing the perfect smart stops and targets.

I have had a lot of great trades recently that I have been sharing in my daily analysis webinars that were the perfect example for this session – perhaps a little too perfect!

Nonetheless, knowing the fundamentals of how to place your smart stops and targets will make your trading that much more profitable and successful.

If you follow the rules I have for these trade parameters, you should find yourself with easy to hit targets and hard to hit stops.

Below is a written counterpart for the live session in case you don’t have the time to watch it.

Feel free to leave any comments and questions!

Barriers

With both your stop loss and your target you need to be aware of where barriers are.

But what exactly are barriers? Well, they are:

- Areas of SR

- Recent highs and lows

- Recent areas of congestion

- Historical highs and lows

So for your stop loss, you want to place it behind these barriers. You are placing your protective wall just behind this barrier of price.

For your target, you want to place it before these barriers. Imagine if you placed your target beyond a yearly high – it wouldn’t be a surprise if your target was never hit because there is a very strong barrier in front of it.

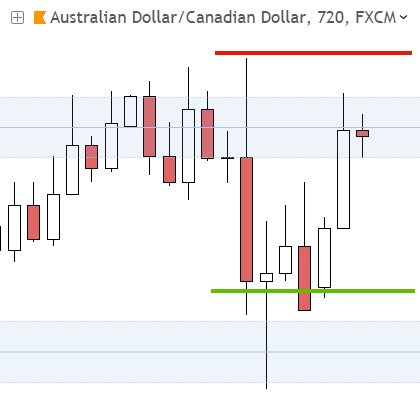

In the image below, the blue areas highlight the barriers of support and resistance.

As you can see, the red line indicates where we would put our stop loss. It is a few pips above the recent highs, behind the barriers.

Our target is a bit trickier. Start simple and work your way forward though!

You know you want to place it before support as well as before the lows that price has recently reached.

So you can look to place it before those barriers. This is where your balance of RR comes into play.

Your decisions about where exactly your target is placed will also differ slightly to others. That is completely normal – it is important to make independent decisions so that you can rely on yourself in the future.

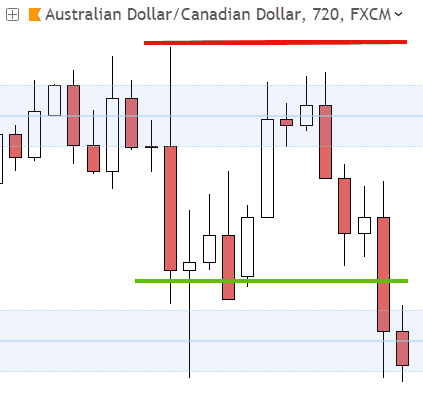

Here is how the trade played out:

As you can see, price actually pushed further than our target, which is great.

But the most important thing is that it was hit. You can’t let greed take control of your trading, so if you see a trade go like this you need to consider your trading psychology.

Do you look at this and think, “Great, that’s a profitable trade, onto the next!” or “Damn, I could have placed my target lower and gotten more money from this trade”.

Overall, placing the perfect stops and targets is deceptively difficult.

This is partly why I strongly encourage traders to start by demo trading. Small changes in how you think like this can and will impact your profitability and success as a trader.

Building up experience is going to literally pay off when you start live trading.

Realities of Trading

There are, however, some realities of trading where price is, at some point, not going to reach your target. This is simply a reality of trading so you should not beat yourself up over this.

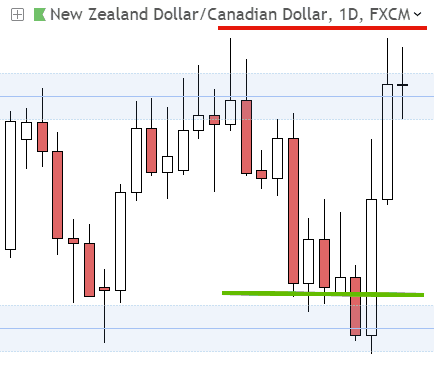

NZDCAD was a recent live example that featured in my analysis:

You can see that the smart stops is behind barriers and our target is before support and the previous lows into support.

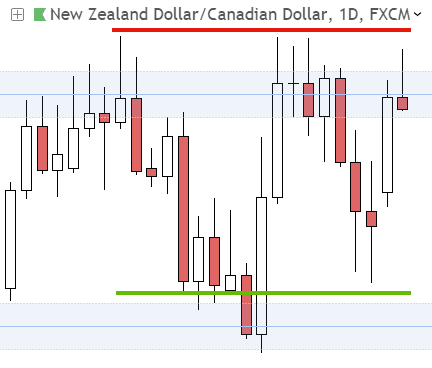

How it played out is a frustrating example, but a good lesson to learn nonetheless.

Greed can be a factor in your target not being hit. Depending on your minimum RR, you could have exited this trade earlier than the target on the chart.

In reality though, you would have placed it at the support level – and that is okay!

You can take measures to combat this, like taking out part of your position at certain price levels, or using a moving stop loss to name a few.

If you are able to perform the fundamentals of trading well, you will see the positive results in your trading.

I highly recommend you check out the live session as there is a lot more that I discuss in regards to this trading topic. It was a great session, so thank you once again to everyone who could attend. I’ll see you at the next one!

Comments are closed.