Whenever you enter a trade you always want to see it turn into something profitable for you. In this way, trading is a very simple idea of trying to execute one goal.

However, there are smaller details and decisions that have a huge impact on whether or not you achieve that profit. Not only that, decisions you make can have a big impact on the size of that profit.

In my most recent free forex live training session, I go over how to let your winning trades run using price action.

This will play a pivotal role for your trading.

Do you want to know…

- How to set the right targets for your strategy?

- How to tell whether you should stay in a trade or get out?

- How to adjust your stops and targets to make more profit?

- How to take out part of your profit whilst keeping a trade open?

Well, in this webinar and accompanying article, these are the exact topics I go over!

But before we dive in, I promised you that I would share my free forex trade tracker to help you in making the most profit possible!

You can download it from File at the top left, or if you want to use it on Google Drive simply choose to make a copy.

Maximum Favorable Excursion

Maximum Favorable Excursion (MFE) may sound scary when you first hear it. In reality, it is a very simple idea that is going to help you become a much more profitable trader.

This topic is all about understanding your targets and where best to place them. This obviously impacts your risk-to-reward ratio and, as you will read later on, your stop loss as well.

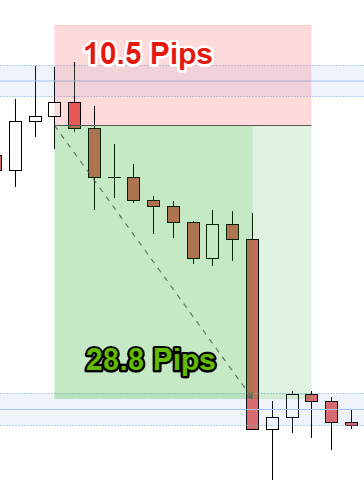

It is best understood with an example, so let’s take a look at a NZDUSD trade I took a few months back.

This trade had around a 2.7 risk-to-reward ratio.

Stop Loss: 10.5 pips

Target: 28.8 pips

Not a bad trade by any means – but you can see on the chart that price went beyond where my target was.

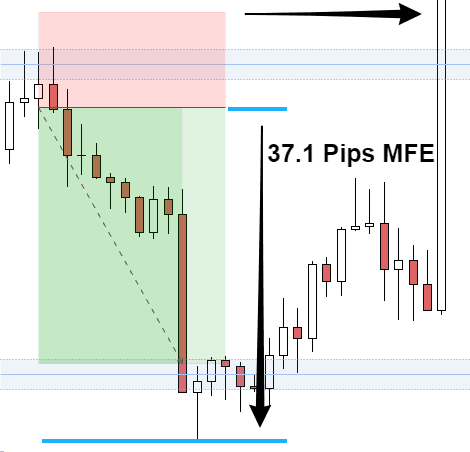

MFE now comes into play.

The MFE is the maximum level price reached from my entry before returning to my stop loss.

So price actually ended up pushing 37.1 pips from my entry. That is the MFE for this trade.

But what do we actually do with this data? Well, that is where the trade tracker I shared at the beginning of this article comes in handy.

There is a separate column for you to plug this data. The reason we want to track it is so that you figure out where your most optimal targets are!

That is going to increase your profitability by a large margin in such an easy way.

It really is that simple: knowing your MFE is going to make you a much more profitable trader!

Tips for MFE

I want to make sure you guys can get the most out of using MFE so here are a few tips that I think will help you out

Firstly, calculate the MFE for each type of setup that you trade. For example, you should have a different MFE for reversal trades and a different one for continuations.

This is going to make your data more accurate and increase the optimization of your targets.

Calculating your MFE is great but it is just a starting point. If you want to make the most out of this you should back test it on your actual trades.

Now, you can actually use MFE on your losses as well!

This is a really valuable piece of information. The MFE will tell you on average how far price pushes toward your target before turning around and hitting your stop loss.

So if that average is, say 30 pips, you know that if price turns around on or before that amount, you may want to exit a trade early.

With this you can minimize your losses by a huge amount!

So not only does MFE optimize and maximize your profits, it also minimizes your losses.

Another use of MFE is to look at the big numbers in your data – trades where you missed out on a lot of potential profit. You want to look at these trades and see if you can find anything that they have in common.

I’ll use my own results as an example.

I found that I should extend my targets when the trade is in the same direction as the major trend. I kept missing out on a lot of potential profit and was able to remedy that through MFE.

Another one was that I should extend the targets of any trades that started off with a lot of momentum.

These are simple and easy to understand ideas but with trading that is often the case. The hard part is coming to the right conclusions for your own trading.

With MFE, you can really optimize your trading and make the most out of every single trade, whether it is a winner or loser.

Feel free to leave me all your questions and comments here.!

Comments are closed.