In trading the amount of profit you can generate is largely influenced by the trading capital you have. If you start with less than $1,000 it will take you much longer to earn $5,000 than if you started with a $100,000 in trading capital. But it is imporant to have a proper forex risk management plan in place before tackling the markets.

The more trading capital you have, the less risk you have to take to earn the same amount of profit.

So it makes sense that you would want to grow your account quicker if you have less capital. This can be a very slippery slope though…

This is where Forex Risk Management comes into play. How much risk are you willing to take, and how much risk is too much?

Risk Per Trade

There are two key areas of forex risk management that you need to have solidified in your trading plan if you want to grow your account quickly and keep your risk in check.

The first area you should concern yourself with is your risk per trade.

A general rule of thumb is to risk no more than 2% on each trade. This may seem like a small amount but it is critical to stick to this limit.

We know that the more trading capital you have, the more capital you can make, so it goes without saying that you want to hold onto the capital you already have. If you do not practice proper forex risk management and lose too much of your money, you’re just making the entire process of growing your account take longer.

There has to be a balance between the risk you take and the protection of your capital.

2% per trade means you can take a couple of losses and it won’t break your bank account. Sustainability in forex trading is not talked about enough and this amount of risk will give you just that.

Most new traders quit within their first year of trading.

I wouldn’t define that as being sustainable. Don’t make those same mistakes – you want to be a long-term player in the market.

The Forex market is not a casino and it is certainly not a get rich quick scheme.

Your goal should be to achieve a sustainable income stream and keep growing your account.

In order to grow your account at a faster pace, we may need to risk more than 2% though…

Maximum Risk Exposure

2% risk per trade is not the maximum amount you can risk at any one time for your account.

There is something called your maximum risk exposure.

For the majority of traders limiting themselves to one trade at a time is not feasible, nor is it necessary.

One week in February, 2021, saw 9 active trades at one time! Getting into 2, 3, or even 4 of those trades is possible and very profitable.

But in order to do that, we have to have proper forex risk management. We need to manage our risk in a sensible way that simultaneously protects our account and enables us to grow it quickly.

The method to achieve this is your maximum risk exposure.

What this means is that you will have a maximum % risk across all your open trades.

A general rule of thumb is to have a maximum risk exposure of no more than 5%. Let’s look at that in an example.

Let’s say you are entering three trades. You can then divide up that 5% risk across those three trades.

So you could enter two trades at 2% each (total of 4%) and the third trade at 1% which would take you to 5%.

You might prefer to have two trades risking 1.5% each and 2% on the third trade.

You get the idea – you can divide your risk however you want.

What is key to remember here is that you are not breaking the 2% risk per trade rule. Sticking to that rule is crucial if you want to prevent greed from taking over your trading.

This is how you can grow your account at a good pace whilst simultaneously protecting your trading capital.

But what about a different kind of risk, one that concerns taking your profits?

Target Extension

At the start of every trading year we forecast what we believe are the some of the best setups traders can focus on in the coming year.

Check out our webinar from back in 2021 on this subject, best trading setups for 2021.

In this webinar, we prioritise breakouts for 2021.

Breakouts are setups that take advantage of trending pairs and this was on show throughout February 2021.

Riding these trends can prove to be low risk and high reward, with target extension occurring frequently when compared to other trade setups, like reversals.

So our concern of managing risk here is when the best time to exit your trade is.

Do you exit once the price hits 1.5 Risk-to-Reward ratio (RR)? Price is trending so if your target is reached quickly, extending it is definitely a consideration.

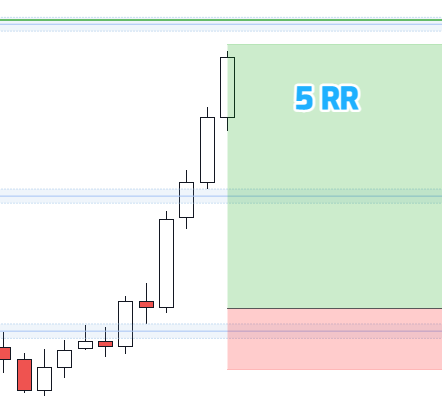

Check out this AUDCHF trade a member of BullRush Academy took last week.

By the end of this trade a Risk-To-Reward ratio of 5 had been achieved!

But that would only be a reality if you actually exited the trade at that exact moment…

Looking at this chart, it is easy to let greed take the wheel and dictate your decision-making. Price has broken resistance multiple times now – what’s to keep it from stopping?

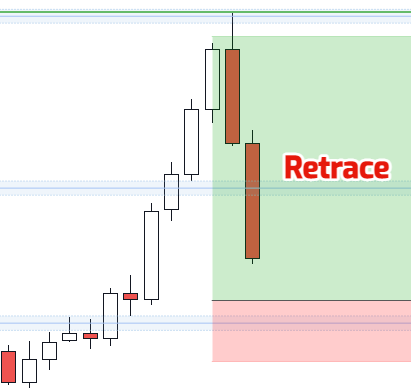

Well, every trend and every push has to end at some point…

This is such a large turn around that if you didn’t have a trailing stop and were still in the trade, you would have lost out on a lot of profit. This is where proper forex risk management comes into play.

Correct placement of your stop loss and exiting at a smart time is crucial to finding success in trading.

You don’t need to risk the profits you have made by letting greed keep you in the trade. A Risk-to-Reward ratio of 5 is incredible to get off of one trade, even an Risk-to-Reward ratio of 3 is fantastic.

Target extension is one of the best and simplest ways to increase your profitability, but you need to make sure that you don’t let greed takeover and actually end up losing some of your profits!

To summarize, when trading forex it is imporant to have a proper forex risk management plan in place. Trading without this can lead to your emotions taking over and blowing your account. Maximum risk per trade, maximum risk per open positions, and having target extensions are all imporant elements of a proper forex risk management plan.

Comments are closed.