Last night I held a webinar on trading Forex in the currently low volatility conditions we are experiencing. Below you will find the webinar along with extra information.

In the last few months, Forex has fallen to a period of extremely low volatility. At the moment, volatility is going back up. However, it will be a long climb before volatility reaches mid 2013 levels again.

For me and the forum members, these conditions have been fantastic. A lot of people see low volatility as a bad thing. However, if you know how to trade in it, low volatility can be great.

Why is low volatility great?

Well, one of the biggest reasons is that there are less surprises. Low volatility markets are much more relaxed and much more predictable. You may make less pips, but who care about pips…

… As a Forex trader you don’t measure your success in pips.

If Bob is making $100 per pip and Time is making $10 per pip, Tim needs to make 10x the pips Bob has to make to equal Bobs profits. You calculate profit and risk based on a percentage of your total trading capital. Since you can have much tighter stops in low volatility conditions, you can trade more lots. So less pips will equal the same amount of money.

Low volatility has been causing issues for a lot of traders. If you look at Forex forums, or trade following services, the performance of many traders has gone downhill.

Why?

Because these traders do not know how to adapt to current market conditions.

Adapting your trading to current low volatility conditions

One of the best aspects of trading price action is that price action works in all market conditions. There will always be a few changed you need to make, but with price action those changes are minor.

The main changed I have made to my strategy in the last few months are as follows.

- I have tightened my stops and targets.

- I have tightened the space between my support and resistance areas.

- I have been adjusting my support and resistance areas weekly as opposed to monthly.

These are all the changed I had to make to adapt to current market conditions. In the video below I will show you my strategy in action. Before I do that, I want to talk a trade that a viewer of the webinar alerted me to during the webinar.

The EUR/GBP Long

After last nights webinar, a whole lot of trades triggered. This was no surprise as the massive move caused by the European interest rate news had to retrace at some point.

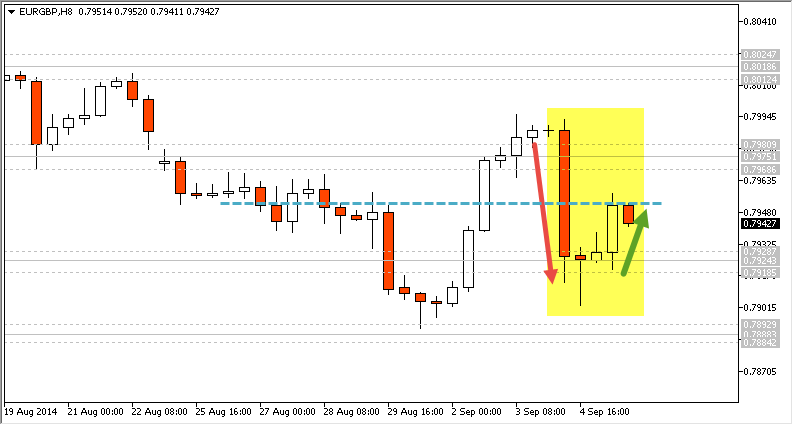

During the webinar, a webinar attendee spotted an awesome trade set up on EUR/GBP and asked me to check it out. This can be seen at around about the 37 minute mark on the video. Below is an image of the set-up during the webinar.

This was an awesome reversal set-up. I was in two minds about entering it as NFP was coming up the next day. However, in the end I jumped in for a quick 23 pip gain.

I ended up entering this trade in bed at around about 6:00 am my time. I waited for price to retrace to around about 0.7927. I only entered this trade because I could get a very tight 10 pip stop on it. My first target was at the blue dotted line, which was 0.7952. Since NFP was nearing I ended up closing the full position at 0.7952 instead of holding out for a second target.

So, thanks Andrea for spotting this trade in the webinar!

An important thing to note about this trade is that I did not make any changes to my normal position size. So technically, this trade was not a huge gain. What do I mean by this?

Well, let’s imagine I normally risk 0.5% of my account on a trade with a 30 pip stop and a 60 pip target. If I have a 10 pip stop and a 25 pip target, I would still risk 0.5% which means I would need to trade more lots. In this case, I did not change my lot size, so the 25 pip gain was more like a 15 pip gain when compared to an average trade. Either way, profit is profit, so I am happy with the trade.

Some of the other trades taken on the forum were EUR/USD 8hr long and USD/CAD 6hr short.

We do not normally trade this close to NFP. However, for me, it was really hard to pass up on the opportunity to make some quick profits from the retrace of yesterdays fall.

Trading Forex in Low Volatility Webinar

That was pretty much the longest written introduction I have ever done for a webinar. I hope you got through it all though, I know you are anxious to see the webinar, so here it is…

My Free Price Action Strategy

If you want to know more about my strategy and how I trade, here are a few links.

- Check out the Free Price Action Strategy section for a break down of my strategy.

- Recent webinar on candlestick analysis in my strategy.

- Recent webinar on how I place and use support and resistance areas in my strategy.

- Recent webinar on how I use support and resistance together with candlestick analysis to enter price action reversal trades.

Questions?

If you have any questions as them using the comment form below. I try to respond to every comment.

Comments are closed.