Updated on June, 14th, 2015

Master candles do not work anymore

Looks like you stumbled upon this article looking for information on master candles. I am sorry to say, master candles do not work anymore!

This article was originally written in early 2008, master candle trading was awesome back then.

These days, market conditions have change, and master candle trading just isn’t that good anymore.

Let me show you how the Forex market has changed…

This chart shows you the change in the AUD/USD average daily range each year, since 2006. In 2008, AUD/USD was ranging a massive 158 pips per day, on average. Today, in 2015, it is ranging only 99 pips per day.

The same thing has happened to all Forex pairs. In 2008, GBP/JPY was ranging over 350 pips per day on average. Today, GBP/JPY is ranging less than half what it was in 2008.

The drop in average daily ranges has made it almost impossible to trade master candles. Master candle trading relied on large breakouts, when GBP/JPY was moving 350 pips in a single day, these breakouts were easy. These days, pairs just do not move enough for master candle trading.

What should you do now?

Try trading price action reversals!

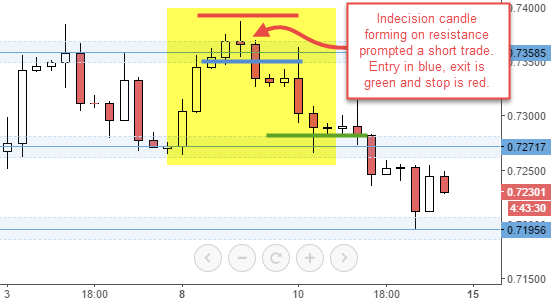

These days I have gone back to trading price action based reversals. I use a combination of support and resistance, with candlestick patterns, to trade these reversals. If you want to know exactly how I do it, check out my free price action reversal strategy.

Reversal trading is low stress, and pretty easy. Check out this recent set up I took this week. It was on EUR/GBP, and it worked out great.

Not all my trades play out this well. However, I do have a very high success rate.

More free price action lessons

Below you can find links to over five hours of recent price action webinars. In these webinars I discuss my strategy in detail.

- Trading my price action strategy on past data

- How to place support and resistance areas

- My advanced price action strategy explained in three webinars

Hopefully you can adjust to Forex without master candles!

The post below has been preserved for posterity.

Master Candle Trading in 2008

In my previous post, I talked about the need to adapt to changing market conditions. I explained how at the moment because of the financial crisis, and the lows GBP/JPY has made, I would no longer use S+R lines.

I am still trading the NickB method, as it is detailed in the video course and free e-Book. I have just retired a part of the method for a little while. Now I want to add something new to the NickB method. It is a little something I picked up from a fellow trader… master candles!

What Is A Master Candle?

Master candles were first introduced to me by a fellow trader from my site. They’re very simple and fit in well with my trading method. Master candles are basically two scalp lines that form a recent high and low on a 1hr candle. You can use master candles on higher timeframes but I use them only on the 1hr.

Spotting a master candle is very easy and trading them is even easier.

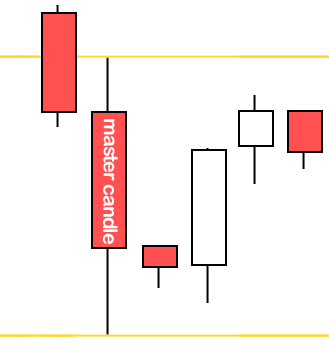

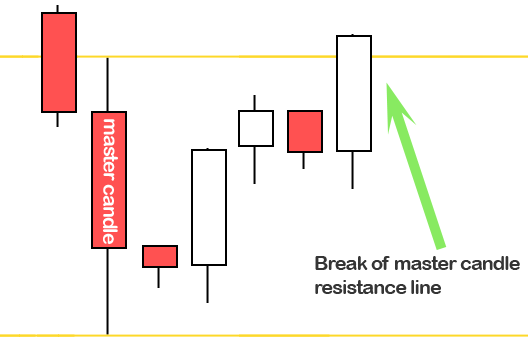

A master candle forms when a large candle engulfs the following four or more candles. Take a look at the example below;

The minimum number of candles the master candle needs to engulf is four, but the more the better. When a master candle forms it is an area of support and resistance being set. If you’re familiar with my method, you could think of master candles as mini scalp lines. Just because they’re mini it doesn’t mean they do not work though. These lines work very well.

Spotting a Master Candle

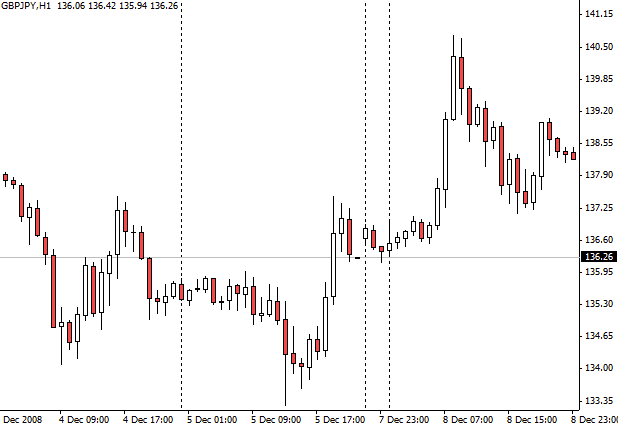

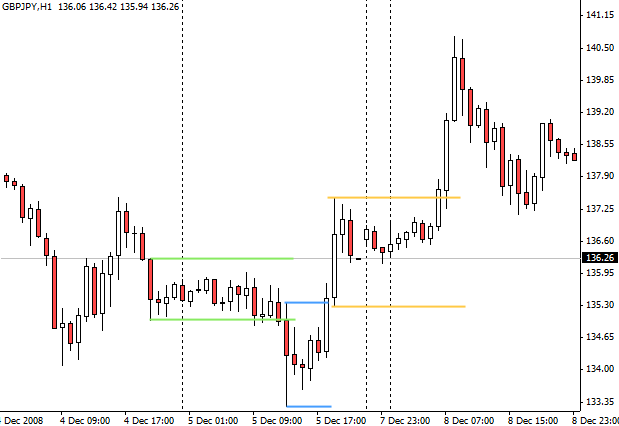

Can you see the master candle in the 1hr GBP/JPY chart below?

Well here’s a little help. There are three master candles on this chart. The first is marked by the blue lines and it engulfs four candles. The second is marked by the orange line and it engulfs 12 candles. The third is marked by green lines and engulfs 16 candles. Unfortunately the green one did not work out but nothing works 100% of the time!

Trading a Master Candle?

Trading master candles is even easier than spotting them. All you need to do is trade breaks of the support and resistance lines created by the master candle. It is pretty much exactly like trading scalp lines with my method.

Targets

Targets are up to you. After taking one of these trades I usually move up to the 4hr chart and look for any nearby danger areas. Areas such as scalp lines or S+R lines can be significant obstacles. Personally, I try to keep the target the same as I would on a normal scalp line break. So I will usually aim for around 50 pips.

The more candles that are engulfed by the master candle the more confident I am that a break of the support or resistance will make me pips. So usually if there are 7+ candles engulfed I will raise my target to 60 pips. If there are 10 or more candles engulfed I might raise my target to 100 pips.

As always, targets are dependent on market conditions and are assessed based on what I see on my chart, at the time of the trade. There is no one size fits all in terms of targets. For example, there could be 15 candles engulfed by the master candle but we could be in a low volatility market so I will only target 30 pips.

This is not a whole new trading method. This is just a new addition to the NickB Method. I use it in conjunction with my analysis. In the next article, I will show you how to use master candles to make big pips!

I will be adding videos about master candles to the video course and I will discuss master candles in the next free e-Book update.

Comments are closed.