How happy would you be if you could reduce bad trades, spend less time trading and make more profit?

You would love it!

But what stops you from trading less and winning more is something that most traders do wrong.

I call it the “baby time frame syndrome”

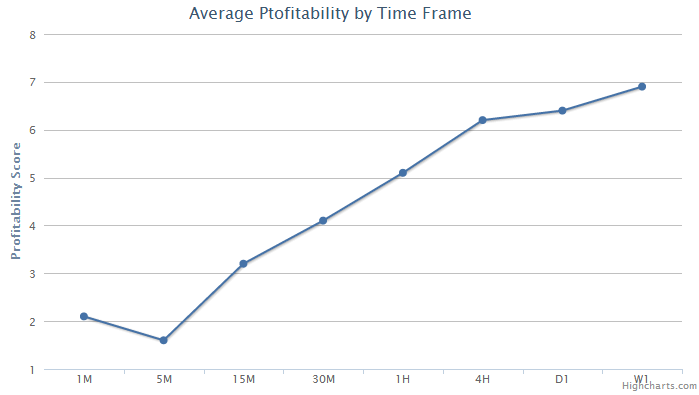

Forex Profitability Chart

Below is the chart if you want to take a closer look. This chart shows the average profitability by time frame based on data from over 360 surveys.

What Do You Do Next?

So you know what the ‘baby time frame syndrome’ is and how it can negatively impact your trading. Now it is time to cure yourself of the syndrome by following the simple three step plan below:

Step 1: Get a Trading Strategy

Find a good large time frame trading strategy. I recommend my dead simple and highly profitable free Forex Price Action strategy.

Step 2: Fix Your Trading Plan

Put together a new trading and money management plan. Again I got you covered here with the free forex video course.

Step 3: Make Some Pips!

Start trading larger time frames and watch your trading results improve.

Let me know what you think about this post by leaving a comment below.

Comments are closed.