Profitable Forex trading requires a plan

Before I give you my five tips for better trading, you need to know one important thing…

… If you do not have a trading, risk, and money management plan. You may as well quit trading today.

If you want to be a successful trader, you must have proper plans in place to achieve success. A good set of plans will:

- Keep you on track and motivated

- Keep you from blowing your entire Forex account

- Help you to manage trades and risk

- Help you to optimize your trading strategy

If you need help putting together a trading, risk, and money management plan, check out my free Forex course. In the course I show you exactly how to put together the perfect plans, and I share my plan templates with you.

5 tips to profitable Forex trading

1. Use Support and Resistance

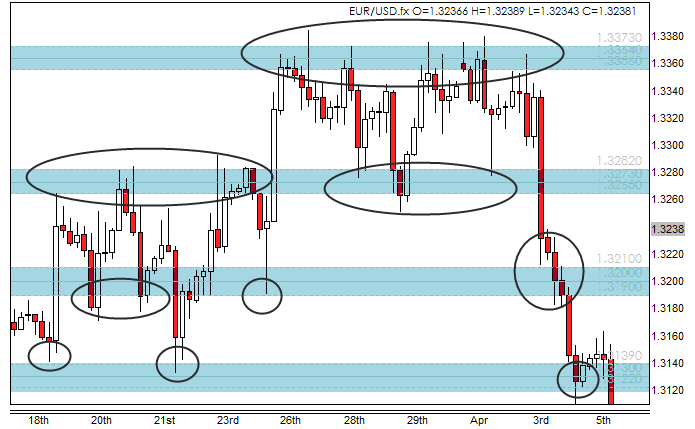

Support and resistance is one of those things that all newbie traders hear about but few use properly. I believe that all traders should place support and resistance areas on their chart. It doesn’t matter what strategy or system you trade, even if you trade EA’s, support and resistance is vital.

support and resistance areas tell you precisely where price most likely stall or bounce. Traders strive to achieve even the slightest bit of insight into what price will do in the future. support and resistance areas give you that insight. Just check out the chart below and see how accurately price reacts to the highlighted support and resistance areas.

Whatever trading strategy use the insight that Support and Resistance gives you can help make you more profitable. So start placing these areas on your chart. Check out my free Forex price action strategy to see how I place my Support and Resistance areas.

2. Plan Your Trading Week

Planning your trading week is essential. Sadly, many new traders do not plan their trading week.

Planning your trading week is essential. Sadly, many new traders do not plan their trading week.

Every Saturday I go through a simple two step process that prepares me for the coming trading week. It only takes me about an thirty minutes.

- I check and write down all major news releases that are due in the next week. This saves me from entering trades at the wrong time. I wrote a post about this last year which you should check out.

- I go through every pair I plan to trade in the coming week and do my price action analysis. This includes adjusting support and resistance areas and identifying key price levels. You can see my weekly price action analysis on this blog.

These two simple steps prepare me for the week ahead, and help me avoid stupid mistakes.

3. Mastering Forex takes time, a long time

I have said it a hundred times on this blog, Forex is a career, not a get rich quick scheme. You need to realize that becoming a full-time Forex trader, can take two to three years, and sometimes longer. If you are not ready to commit yourself to learning Forex, for at least one year, then you may as well give up now.

I have said it a hundred times on this blog, Forex is a career, not a get rich quick scheme. You need to realize that becoming a full-time Forex trader, can take two to three years, and sometimes longer. If you are not ready to commit yourself to learning Forex, for at least one year, then you may as well give up now.

If you want to become a profitable trader, you need to understand, it will take a long time, and a lot of hard work. There are no short cuts, and no magic bullets in Forex.

I wrote about this recently in the get Rich Slow article. I also wrote another article recently in which I mapped the road to success in Forex.

4. Keep a Trading Journal

Keeping a trading journal allows you to track your mistakes, and learn from them.

Keeping a trading journal allows you to track your mistakes, and learn from them.

Trading journals also help to you to recognize flaws in your strategy.

About two years ago I started to keep a trading journal. I tracked every single trade that I took. After six months, I noticed a pattern forming with some of my losing trades. Trades I opened just before New York close, had a 79.18% failure rate. Without a trading journal, I would not have noticed that pattern.

So, imagine finding all the little mistakes in your trading…

… I talk about trading journals in lesson 5 of the free forex course along with sharing my trading journal template.

5. Build Your Own Strategy

This tip may sound scary, but don’t worry. You do not need to build your own trading strategy from scratch.

This tip may sound scary, but don’t worry. You do not need to build your own trading strategy from scratch.

I love my price action strategy, because it suits my style of trading…

… But does it suit yours? Maybe yes, maybe no.

Forcing yourself to trade a strategy that clashes with your personality, is not a good idea. The key is to take the parts of the strategy that work for your, and use them. It may take a long time, but eventually, you will be able to build a unique strategy, that works for you.

Where these tips helpful? Leave a comment below and discuss them or throw in your own tips!

Comments are closed.