I first wrote this blog post all the way back in 2012. Since then, trading range bounces has remained one of the best setups in price action trading. The win rate of range trading is the best out of almost all setups that I use with price action.

That can be true for you as well.

But the success of trading range bounces is not down to just one reason. There are multiple reasons that make trading ranges some of the best times a trader can have. Let’s take a look at trading range bounces and everything they have to offer.

Profitability

The great thing about my price action trading strategy is the flexibility it offers. Price action can fit into many different trading styles and offer a lot of different setups.

You can find ranges on multiple time frames – the 1 hour, 4 hour, daily and many more – any time frame you want can have a range.

With most ranges, you can look to get at least 2 trades. A lot of the time, you can get more than 2 trades and that means a lot of profitability is coming your way.

On a 4 hour chart, you can expect an average of 40 pips per trade which results in 80+ pips of profits.

If a range forms on the daily chart, you can expect an average of 80 pips per trade. So with just 2 trades on a daily chart range, you can be over 160 pips in profit. But that is just 2 trades! You could catch 3 or 4 trades from a single range – on any time frame.

The profitability of trading ranges is unrivalled. But this isn’t the whole picture.

Those numbers look and sound great, but how can we be sure that you actually lock in those profits?

Reliability

There is a unique aspect of trading range bounces that is the reason for its high win-rate.

The reliability of trading ranges is the most reliable setup you can expect in trading.

Ranges are the perfect areas to make profit because they form between an area of support and an area of resistance. Do you know what else we call support and resistance?

A buy zone and a sell zone! So, when price moves up it hits the sell zone. When price moves back down it hits a buy zone.

This makes for some incredibly reliable trading. Let’s take a look at some examples.

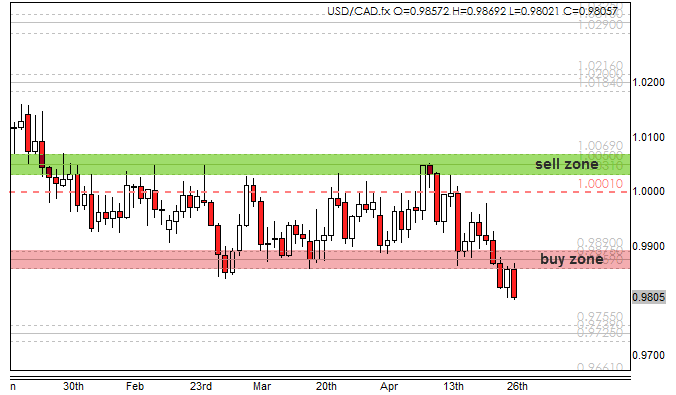

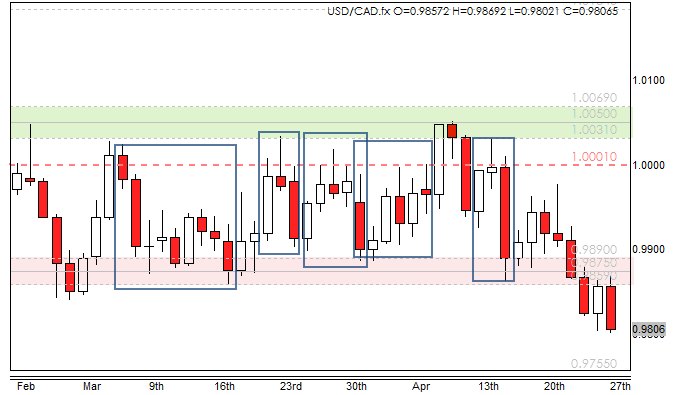

Above, you can see my USD/CAD daily chart. This pair was trapped in a range from January 27th to April 25th. The red dotted line on the chart is the 1.0000 psychological level. This range had some very easy reversal trades that I was able to take advantage of.

If you have read my price action strategy you will know how I trade reversals so I won’t go over it in detail. The basic idea is to look for a preceding trend followed by an indecision candle forming on top of support or resistance.

I have marked out 5 reversals that formed in this USD/CAD range. Out of the 5 trades, only the first one failed. With USD/CAD I target 60 pips on a daily chart reversal as the average daily range is only 80 pips.

Together, these five trades made roughly 210 pips since February! Now, 210 pips may not seem like a lot, but there is one last reason as to why ranges are one of the best setups in forex.

Maintenance

There is always a cost to anything you do. Whether it be time, money, or patience, you have to put something in, in order to get something out.

Trading range bounces is one of the lowest maintenance trade setups you will ever come across in forex trading. There are two clearly defined areas of interest that you need to focus on.

The support area (buy zone) and the resistance area (sell zone). Once price reaches these areas, you should be looking for a trade. Once you are in a trade, all you need to do is look toward the other side of the range for your target profit.

If price reaches your target, you can immediately look for another potential setup! Trading ranges is incredibly easy and low maintenance once you have found one.

This means you can put in less time for easy profits that have a higher reliability than other setups. Trading range bounces really is one of the best scenarios to find yourself in as a trader. Spotting and trading them are relatively easy as well, so if you are a beginner you can start looking for them straight away!

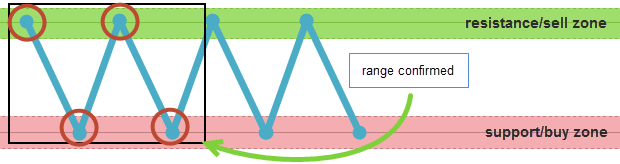

Spotting Ranges

Spotting a range is straightforward. I simply look for two bounces on the support and two bounces on resistance. Once I see those, I know that the range is confirmed and I can trade it.

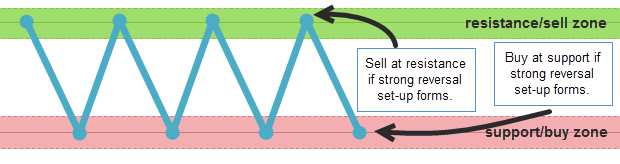

Trading Range Bounces

The concept of trading range bounces is the same as reversal trading. In a range price dips down into a buy zone and reverses up into a sell zone.

In theory, you could trade every single dip and rally but this would be dangerous. You can never know when the price will break the zone. If you only look for strong reversal setups forming in either the buy or sell zones then you can make some very easy pips. So, have a read of my price action strategy, learn to trade reversals and make some pips!

Comments are closed.