I have been working closely with a small group of newbie traders recently. Working with newbies has forced me to remember a lot of Forex knowledge that I have forgotten. A lot of this knowledge has become instinctive in my trading so I use it without knowing or thinking about it. One of these pieces of knowledge is how vital knowing and being wary of a pairs average daily range (ADR) is.

Why should you worry about a pairs ADR?

Well, when a pair reaches its ADR for the day it tends to slow down, which makes it much harder to trade the pair.

Below are the current 200 day ADR figures for E/U and G/U:

E/U = 128 pips

G/U = 116 pips

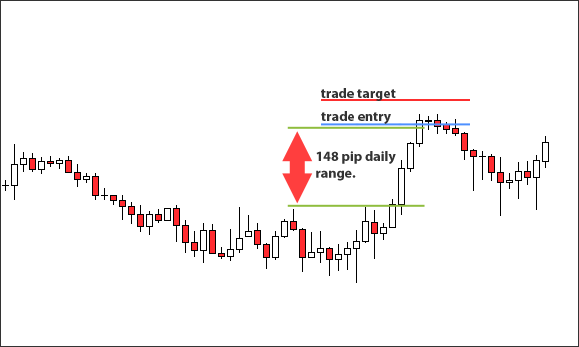

Let’s imagine E/U has ranged 148 pips today, which is 20 pips beyond it’s ADR, and I see a good trade set-up on it. If entering the trade set-up will require me to set a target that goes even further beyond the ADR this trade might be a bade move. This is because statistically E/U cannot be expected to range much more than it already has. So if I enter the odds would be stacked against me from the start. You can see an example of this trade below, the green lines show the days range, the blue shows the trade entry, and the red the trade exit. As you can see after the trade entry EUR/USD ranged up 10 more pips before the price stagnated and reversed.

There will certainly be days in which the ADR is greatly surpassed so you shouldn’t immediately dismiss a trade because the pair has reached it’s ADR. However, it should definitely be a factor when considering a trade.

Have any questions? Leave a comment below and I will answer them!

Comments are closed.