“What should I ignore Forex news?

BullRush Academy gets asked this question a lot and the answer is that you should just ignore forex news.

Your initial reaction to that might be “no way, news is dangerous”. Well, many traders have had the same thought as you. The reality though is:

Avoiding forex news will cost you money!

And here are five reasons why.

Just a quick note before we get into this – when we say “forex news” we mean scheduled economic releases, not major political events like Brexit or the US election coming up in November!

#1 Foex Spikes Will Make You Money (on average)

It’s simple math.

Imagine each unexpected spike caused by news is a coin flip. Heads is a bullish spike and tails a bearish spike. That gives each news based spike a 50/50 chance of pushing price in your direction.

Now let’s add in another factor: risk to reward ratio. Most traders use a positive risk to reward ratio, for example, if they risk 20 pips they target at least 30 pips.

So, if you trade with a positive risk to reward ratio the worst case scenario news will push price 20 pips against you, best case scenario it will push price 30 pips in your favour.

Over the course of 100 news spikes big enough to hit your target or stop, you will come out ahead.

This is of course assuming that 50% of the time news will push price towards your target, but will it?

For many traders it does, and that leads us to the next point.

#2 Some Setups Form Because of Upcoming News

Big boy traders like banks and hedge funds known with a high degree of accuracy what impact forex news will have on the market.

How?

They spend millions on buying news and data from companies like Bloomberg and they spend even more paying experts to analyse that data.

As retail traders we do not have access to that level of data, and even if we did, we do not have a team of people to boil it down into actionable trades for us.

But if you are a forex price action trader, none of that really matters.

Because by using forex price action we can see how big boy traders are preparing to trade upcoming news. This is something they cannot hide.

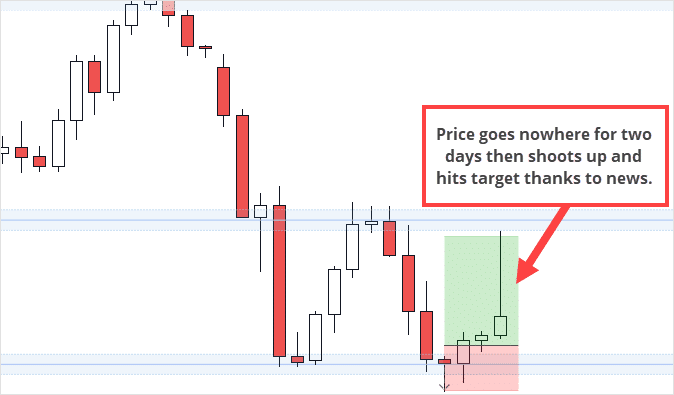

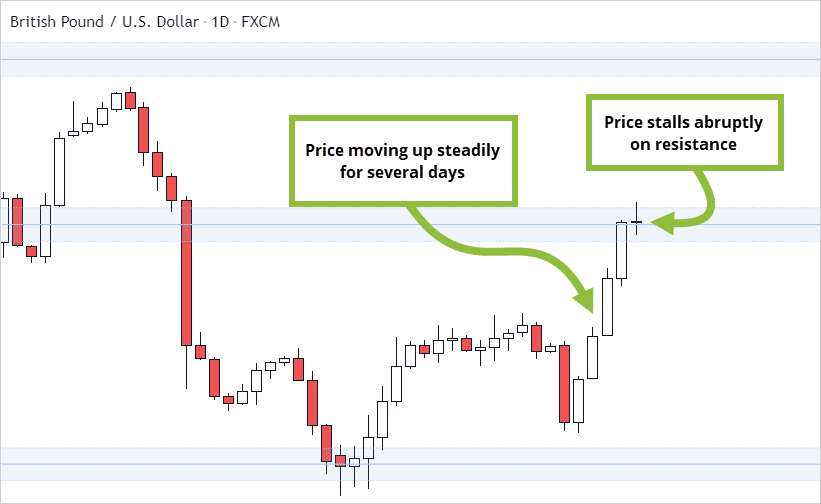

In the example below we see GBPUSD quickly making it’s way down over the course of a few days. Then all of a sudden it stalls out on top of a resistance area. This, for me, is a short setup.

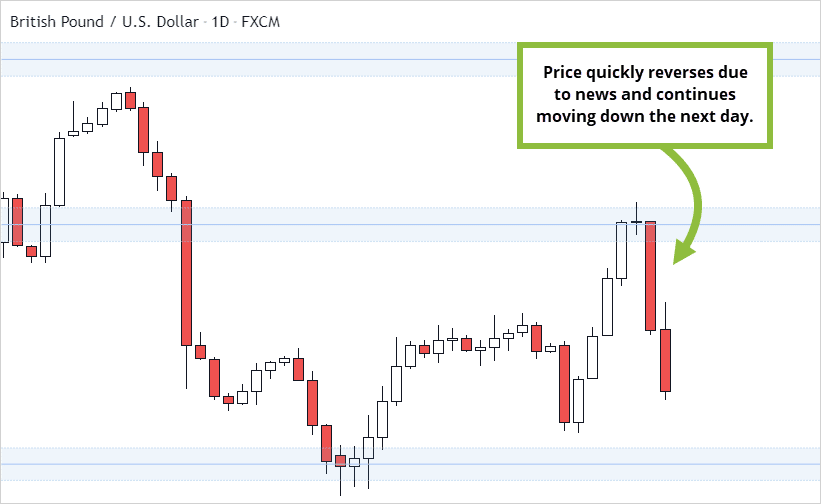

Why is it stalling out? Well, the next day some huge Brexit news is coming out, and big boy traders expect the forex news to be bad for the UK, which is likely to cause GBP weakness.

Since they expect news to be negative for GBP they close their GBP longs and, as a result, GBPUSD stops rising and settles on resistance. The next day when the expected news is released – BOOM!

So this awesome setup only formed because big boy traders positioned themselves to capitalise on a news release.

This doesn’t only happen with major news like Brexit of NFP (NEC). It happens on a much smaller scale with other reports every week. Many of the price action setups I trade form because of upcoming news.

So, in other words, news helps us by creating great trade setups!

In #1 I asked you to imagine that price has a 50/50 short of spiking in my direction. Well, the reality is that forex news usually has a much higher chance of pushing price in my direction.

But even if it didn’t, it still wouldn’t make sense to stay out of trades because of news because…

#3 You Cannot Backtest Forex News

If you are not thoroughly backtesting your strategy you are making a mistake.

But when backtesting over years of data it is very difficult to factor in news. It can triple or even quadruple the already lengthy process of backtesting.

This is why most traders do not factor in news when they back test.

If your back testing does not factor in news, your forward testing shouldn’t either. There is no point in backtesting if you are going to change the variables in forward testing.

In fact, this is a key rule to successful backtesting and forward testing. Once you have something that works in backtesting you need to keep ALL of the variables the same.

The moment you change anything in forward testing it invalidates all of the backtesting you did.

But is it worth factoring news into your backtesting?

No, because most times the forex news doesn’t do anything to price.

#4 Nothing Happens Most of The Time

For the sake of example let’s imagine that when price spikes due to news it hits your stop 80% of the time and goes in your direction only 20%.

This is still not a good reason to avoid trading through news because, the fact is, most news reports do not cause spikes large enough to affect your trades.

In reality, there will be only a few reports each week which cause significant spikes and most of the time these will not intersect with a pair you are trading. So, let’s say that once per week you might be in a trade that has an 80% chance of being stopped out by news.

Does it make sense to avoid all high impact reports because of this? If you avoid all high impact reports you will miss a lot of trade opportunities.

Most traders would rather take five trades per week knowing that one has an 80% chance of getting stopped out by forex news than to take one trade per week out of fear that news would impact the other four.

Keep in mind that we are using an extreme example here, there is not an 80% chance that a news spike will stop you out. If anything news is more likely to push a trade in your favour (see reason two).

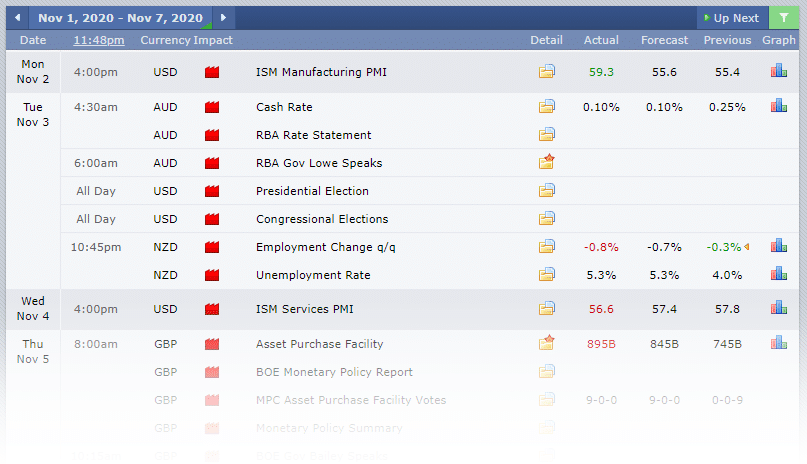

As you see from the images of Forex Factory below, most weeks will have several red (high impact) reports each day.

If you avoid trading around these reports you will miss trades for no reason.

And this brings us to the final reason, calling reports “high impact” is misleading.

#5 What Does “High Impact” Even Mean?

A lot of traders have a blanket rule to avoid all red/high impact forex news releases listed on economic calendars. For example, on the Forex Factory calendar these are the red reports.

Who decides what’s classed as “high impact” and what is their criteria?

Is it high impact on the 1 minute chart or the daily chart? Because a big move on a short time frame 1 minute chart doesn’t even register on the daily.

Is it “high impact” if it causes a big move once per month? Or is once per year enough?

What is the average percentage price change that the report needs to cause in order to be considered “high impact”?

Nobody knows the answer to these questions other than the people who make economic calendars and as far as we know they do not share their criteria.

In our experience, most high impact releases do not have a noticeable impact on the daily chart so as a daily chart trader why should you care?

Why would you skip several trades each week because somebody over at Forex Factory says a report is high impact?

The answer is you shouldn’t.

And this is nothing against Forex Factory, they have an awesome calendar and it is very useful. Our point is just that what they consider “high impact” is not what we would consider high impact.

Do not let somebody else tell you what reports are high impact enough to keep you out of trades.

You Lose More From Inaction Than Action

A lot of traders, even beginner forex traders start their trading journey avoiding all major forex news releases to completely ignoring most news.

Many traders have found that by skipping trades they have a greater opportunity cost than by having a random forex news spike stop them out a few times per year.

It is a case where more is lost from inaction than action.

Do Not Take Our Word For It

You shouldn’t take our word for it.

This is very easy to test out for yourself. Instead of skipping trades because of forex news, simply demo trade them for the next six to twelve months in a BullRush Trading Competition. When you gather enough data you can assess the impact trading through forex news would have had on your profitability.

Comments are closed.