In this Forex blog post we are going to cover the top 5 tips for beginner forex traders.

As in most things, most people do not know where to start. In today’s world there is so much information online that is can be overwhelming. This makes it difficult to find a starting point when learning forex trading. So, to keep it short and sweet, we put together this forex blog on the top 5 tips for beginner forex traders

Whether you have just started on your forex trading journy or are an expert, the tips below will help you in becoming advancing your trading skills.

1. Look Forwards, Not Backwards

Forex trading on a daily basis is inevitably going to bring about some mistakes, lost trades, or missed opportunities. Simply put, you will not be able to avoid these things and they will have an impact on your trading.

So what to do about it?

Traders that are able to accept these realities and move forward with trying to mitigate these mistakes often find success much faster.

A mistake is only a mistake if you don’t learn anything from it. We all make mistakes regularly but the difference between an experienced trader making mistakes and a beginner forex traders making them is that the experienced trader will be unphased.

More opportunities and more trades are right in front of you – all you need to do is keep looking forward at the next trade opportunity.

Succeeding in trading requires practice, time, and a bit of experience, all things that you won’t rack up if you simply stop trading. It happens. Paralysis by analysis, fear of trading, fear of losing – these are all problems that a lot of new traders struggle with.

You have to keep looking forward and apply the skills you’ve learnt and come to understand your own style of trading. Everyone has different strengths and weaknesses and part of the learning process is figuring yours out.

That being said, don’t neglect looking backwards. You can learn from your mistakes, but the key is to not let those mistakes sit in your mind and corrode your confidence and trading mindset.

The best way to do this is through a trading journal so you can look back at your collective results and make adjustments based on your collected data. So don’t fret over every detail of every trade – if you have made a mistake take note of it and apply what you have learned to the next trade.

2. Best Time Frames to Trade

In the next tips for beginner forex traders we cover best time frame to trade. One of the most common problems with new traders is the issue of not knowing what time frame to focus on. Some traders prefer higher time frames, others prefer short time frames – both of these are fine but the key is to choose one and stick to it.

If you are flip-flopping between the two then you will stunt your growth by a considerable amount.

The reason is that, whilst price action is still fundamentally the same, there are key differences between higher and shorter time frame trading that will confuse you (unless you have some experience under your belt).

The first year of trading is the most important year of your trading career. This time period is the one that you are most likely to drop everything and walk away from trading.

You do yourself no favours by slowing your progress down and that means you need to choose the best time frames to trade for you and stick to them for your first year.

Your schedule may also make it necessary to pick one or the other which is fine! You have time in the future to explore other time frames once you have found your feet. But make sure you learn how to walk before trying your hand at running.

3. Transitioning From Demo to Live Trading

One of the more subtle aspects of forex trading is changing from demo trading into live trading.

There are quite a few obstacles here that are worth noting so that you can avoid making mistakes that will make the transition more difficult.

Thankfully, BullRush Trading Competitions are all based on demo trading. These free competitions are the perfect opportunity to test your skills without trading your own capital. Click here to register for a BullRush Trading Competition.

The first of these is that your trading will change slightly, simply because demo trading is not the same as live trading. We encourage demo traders to take a trade versus not taking one if it looks a bit risky. This is because you are testing the limits of trading on your demo account.

So live trading will typically exercise a bit more patience and risk management consideration – don’t be trigger happy in live trading because that is a quick way to lose your capital.

The second obstacle is a mindset one which is harder to pin down. Let’s face it, when you trade with real money, you are going to be in a different headspace as it will impact you much more when you win and lose trades.

Problems of overtrading and overconfidence come about through strings of wins, and fear of trading/losing and paralysis by analysis come about through losing streaks. Be aware of how your mindset changes when you live trade and you can prevent these problems from taking over your trading process.

The third obstacle is looking back at your results and deciding whether or not to live trade.

Based on research conducted, we have found that a gradual switch is better for new traders.

So let’s say you have looked at your 50 demo trades and had good results with a 50% win rate. You don’t need to scrap your demo account and exclusively focus on your live account.

Keep taking trades on your demo account and when you feel you have some strong setups, take them on your live account. Gradually, you can fully transition over to your live account, and doing so will help you adjust and keep your momentum.

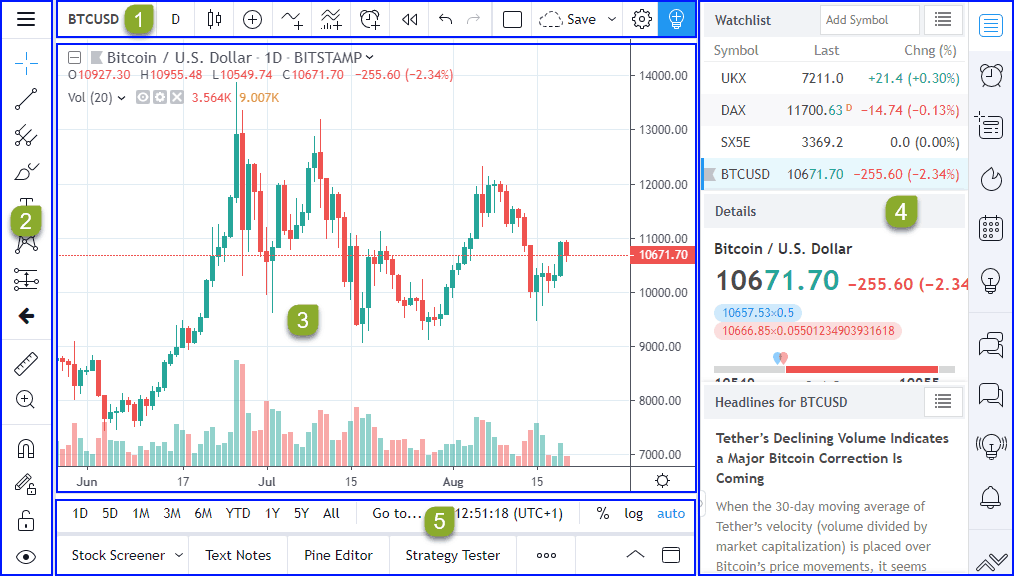

4. Invest in Charts!

Look, a frustrating reality about forex trading is that most brokers have sub par charting software.

It is not a smooth experience, it often does not have enough customization, and generally slows down and harms your analysis.

If you have an unfulfilling and cluttered charting experience, your analysis is likely to suffer as a result. So take a look at TradingView. BullRush trading competitions have Tradingview charts built directly into the trading platform. This makes it easy, and you no longer have to pay for them. BullRush covers the expense for you.

You can try TradingView if you want. If you already have TradingView there are a lot of features so we have highlighted the best ones for price action forex trading. We cover many Tradingview Tips in our recent article titled 3 Tradingview tips to make trading easier.

A lot of your trading time is spent looking at charts so make sure you are not holding yourself back by being restricted in your charting software. More often than not it is worth the investment into better charting software as you will be using it every day you trade.

5. You Are Your Own Worst Enemy…

The last in our list of tips for beginner forex traders is the most important and relates to all aspects of trading. Forex trading is often a solitary and independent endeavor, and as such, only you know all the mistakes, wins, losses, ups and down you go through.

It can be quite overwhelming if you have no outlets or methods to process your work in this regard.

One of the biggest problems we see in newer traders is a lack of confidence in themselves and their progress. You have to realize that you are your own worst enemy, your biggest critic.

Negative thoughts can pile up and chip away at your confidence and ultimately prevent you from trading at your highest potential.

Find some way to process your trading and the emotions around it – and believe me, you will have a wide range of emotions, in both directions, so make sure you acknowledge that fact so you can prepare yourself.

In addition to confidence problems, you are your own worst enemy in that your mindset will dictate your trading behaviours unless you dedicate time to understanding when you are vulnerable to trading poorly.

For example, if you have just lost a trade that was very close to hitting your target but turned around and stopped out, you know that your mindset after something like that will effectively be in the toilet. Revenge trading is something most traders struggle with, and by chasing lost trades you became your own worst enemy and you alone are solely responsible for further losses.

Understanding yourself and your weaknesses is more important than understanding your strengths. The name of the forex game is to protect your capital and if you are aware of your weaknesses, you will excel in protecting your capital and growing your account.

There you have it, these are the top 5 tips for beginner forex traders. Let us know in the comments below what you have struggled with and we will be happy to answer any questions and help out where I can.

Comments are closed.