Recently I have been making some changes to the way I trade. My method has always consisted of two trading techniques; break out trading and reversal trading. I use both of these techniques, in my day to day trading, but there is always a more dominant technique.

From mid-2005 through to 2007 reversal trading was my dominant technique. Strong break outs were not as common during this time. The market had a tendency to have mini-breakouts and then reverse. However, in 2008 through to mid-2010 break out trading became my dominant technique. In this period, strong break outs were common and you could easily make 50 pips on a GBP/USD scalp line break.

Mid-way through 2010 the Forex market changed again and I had to change my dominant technique back to reversal trading. This was all because of changes in the average daily range.

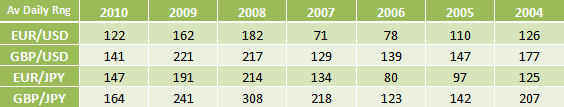

The Forex market has cycles and, as traders, we need to adapt to the changing cycles of the Forex market or perish. So let’s look at some average daily range statistics, for the most popular pairs.

As you can clearly see, in 2008 we had a massive explosion in average daily ranges leading to a golden era for break out trading. Pairs like EUR/USD more than doubled their average daily range between 2007 and 2008. Some pairs not listed here quadrupled their average daily range in that time period. You can read this post from Kathy Liens blog. She wrote it in 2008, as the market explosion was happening.

Implications of Changing Average Daily Ranges

From 2009 to 2010 the average daily range of EUR/JPY decreased by 44 pips. This number may seem small until consider, that in 2009, I would generally have targeted 40 pips on a EUR/JPY trade. In this context, the change in the average range for EUR/JPY is bigger than the size of my total target.

Changes in the average daily range can have a severe impact on the profitability of a trader. Imagine it is 2009 and you have spotted a great EUR/JPY set up. Let’s assume that the pair has already ranged down 80 pips. So on average EUR/JPY will move an extra 111 pips beyond what it has already ranged (191 – 80 = 111). However, if this exact same set up and trade occurred in 2010 it would only have moved an extra 67 pips on average. So in 2009 your trade would have been less risky, the upside potential would have been better and you would have had the opportunity to target more pips.

This is one example that illustrates the difference between a small change in the average range. However, just a 40 pip change can be very significant over the course of a year, let alone a change of 100 pips on the average range.

How Drastic the Changes to My Method Will Be

I never completely stop trading a part of my method. Usually I have a front runner and a runner-up. The front runner is what I use for 60%-80% of my trading. The runner-up is what I use for the rest of my trading. For a few years, break out trading has clearly been the front runner. Now breakouts are taking a few steps back and reversals are becoming the front runner.

So I will not completely give up on trading break outs. However, I will not trade them nearly as often and the set-up will have to be very solid for me to consider trading it.

Why Now?

Some of you may be asking why now? The changes started in 2010 why am I adjusting my method now? Well, first of all, I haven’t just started adjusting my method now. If you look back, for the past several months, I have been saying consistently that reversal trading is becoming more profitable than break out trading. This is simply the first time I posted an explanation as to why.

It takes time to analyse the market and make sure these changes are for real. There are always some months here and there that have high or low ranges. So I have to be sure that ranges actually changed significantly before posting about it.

How Fast Can You Notice Changes?

You can notice these changes within days. However, to notice changes quickly you cannot only use the 365 average daily range. I use two range statistics, the 365 day average daily range (Yearly ADR) and the 10 day average daily range (10 Day ADR).

Yearly ADR – The Yearly ADR is used as above to detect large changes in the average daily range. Changes like the explosion we saw in 2008 are large changes.

10 Day ADR – The 10 Day ADR detects recent changes in the average daily range.

The 10 Day ADR is what allows you to react quickly to changing conditions. For example, if the Yearly ADR for GBP/USD is 150 pips but the 10 Day ADR is 250 pips GBP/USD is ranging above its Yearly ADR. So in this case, you can make quick changes to your technique. Quick changes would be things like targeting more on trades as GBP/USD now has the potential to move much more.

The Yearly ADR cannot be used to react to recent changes, as it only shows you long term changes. So I only use the Yearly ADR to adjust the overall goals of my method. As I said earlier, break out trading has been my focus since 2008. With recent drastic changes to the Yearly ADR my focus is switching to reversal trading. So the Yearly ADR helps me adapt my long term trading strategy.

The 10 Day ADR is extremely important as it allows you to react very quickly to changes. Having different techniques in your method that work in different conditions helps keep you current. So use the 10 Day ADR for quick changes to techniques and targets and the Yearly ADR for overall goal and strategy changes.

When Will Ranges Come Back?

The answer to this is unknown. The fact is that the Forex market is constantly changing. We could return to high average daily ranges this year or in five years. However, none of that is really important. What is important is that you learn to adapt to changing conditions. More likely than not, changes in the average daily range will impact your trading style significantly. At the very least, you will need to lower your trading targets as it will become hard to make as many pips, per trade, as it used to be.

What Now?

Well it is up to you what you do with this information. If you have any questions feel free to ask below.

Comments are closed.