Everybody always says “the trend is your friend”, but when there is no trend you need to make new friends.

And right now, there are no trends.

If you’ve been trading the past few months you may be left feeling a little bit frustrated.

Following an awesome year full of trends in 2018, we now find ourselves staring at sideways movement and tightly ranging pairs in 2019.

Look, the forex market isn’t always going to be trending heavily and giving you those big trades we all like to take. That’s just one of the realities of trading.

However, part of trading forex is knowing how to adapt to changing market conditions.

So let’s take a look at how you can trade effectively in a slow (low volatility) forex market!

It’s All Part of the Plan

A low volatility forex market is nothing new.

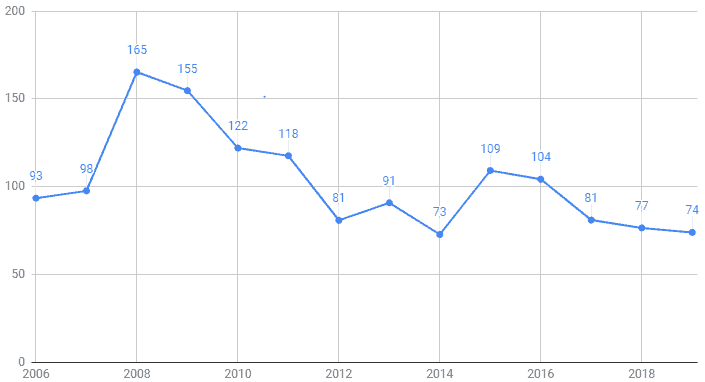

The forex market moves in cycles, constantly rotating through volatile and calm periods. In 2014 we had a similar slow down – the chart below shows the average daily range in pips of all the majors by year.

So right now we have a mix of low volatility and a complete lack of trends. And many traders are struggling to be profitable in these conditions.

But as traders we need to be able to switch our approach to suit current conditions. Which is why I love price action trading – with price action, adapting is quick and easy.

Instead of relying on an indicator I can read price and understand immediately what I need to do in order to trade it profitably.

In fact, in this low volatility market my win rate and risk to reward ratio has actually increased.

How?

Well, there are two key steps I took.

- I stopped focusing on trends.

- I started trading lower time frames (as opposed to daily charts).

So let’s break down exactly how I am trading right now so you can incorporate it into your own trading!

The Range is Your Friend

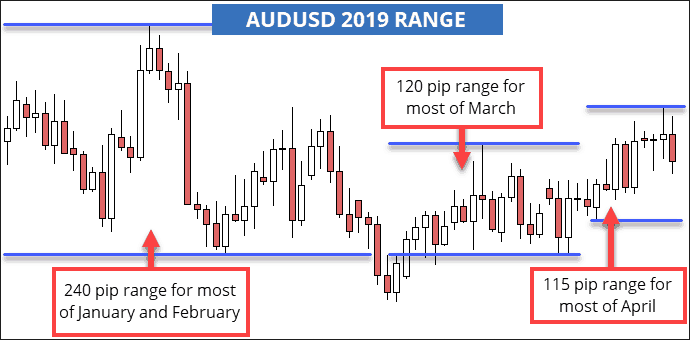

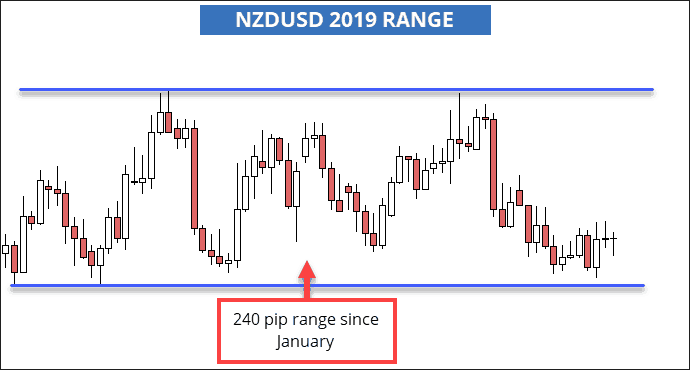

So what does a slow market look like in 2019?

I could put up more examples but I don’t want to have too many images in here. If you want to see more just check your charts. GBPJPY has been ranging in a 500 pip area since March which is a very tight range for the pair. EURUSD has been in a 270 pip range since the first week of February. It goes on and on…

There are almost no major trends to be seen.

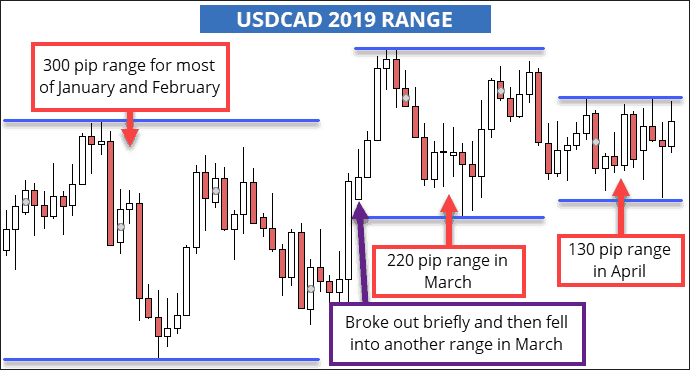

Instead pairs are bouncing between two support and resistance areas on most pairs. Sure it breaks out sometimes but then establishes another range like we see on USDCAD.

Of course some pairs are still trending, it’s not like ALL trends can be gone. USDCHF is trending up at the moment, it’s not a strong trend but it is a trend.

However, overall things are ranging and not trending.

So how do we trade ranges?

Easy! In fact, ranges are much easier than trading trends.

How to trade ranges

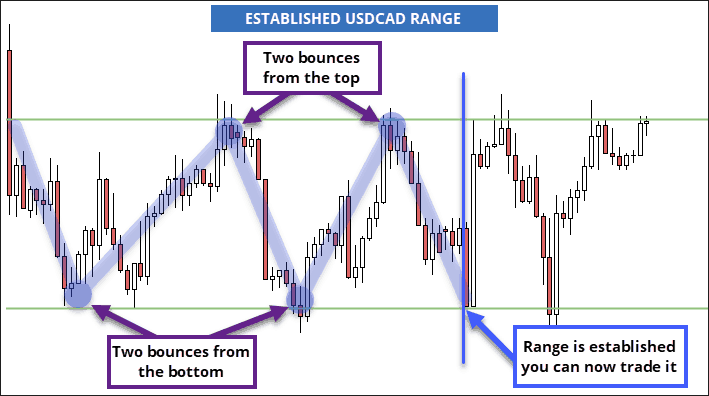

First you need to find a range. Ranges can happen on any time frame, from the daily charts right down to the 5 minute charts. My rules for a range are very simple: I want to see two bounces from the top of the range and two from the bottom.

A bounce is when price moves from the top to the bottom of the range. The image below of a USDCAD H4 chart shows to clear bounces from the top and two from the bottom.

Once the range is established (after the blue line) I short the top and long the bottom of the range. Usually I drop down to a lower time frame wait for confirmation in the form of an indecision candle but it’s not essential.

Once I see an established range I just keep on trading it until the range breaks. The trades are very predictable, very safe and very easy.

I know it seems simple but the proof is on the charts – you can take a look at it yourself.

If you need help identifying range trades sign up for my FREE daily price action analysis.

Trading Lower Time Frames

I love daily chart trading because it is stress-free and chilled out.

But in current conditions taking a daily chart trade often means waiting one week or more for it to hit target. Volatility has slowed down to a crawl so pairs don’t move enough to hit big daily chart targets.

Larger time frame trading is going to be tougher.

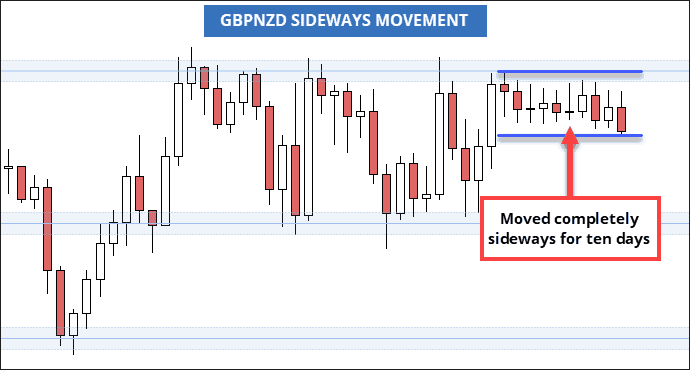

One example is GBPNZD daily chart these past two weeks. Take a look at all that sideways movement, it was untradable…

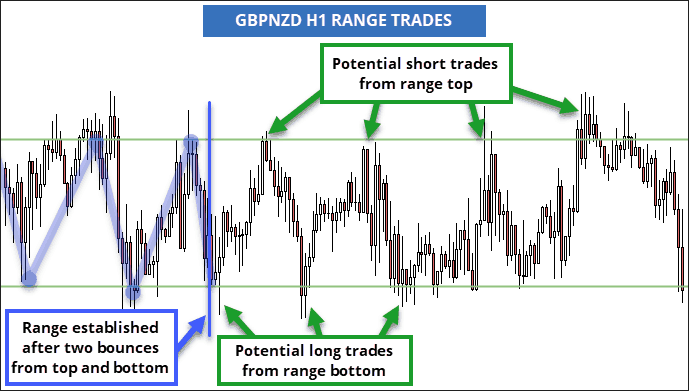

But on the 1hr chart we see an awesome range with a lot of trades.

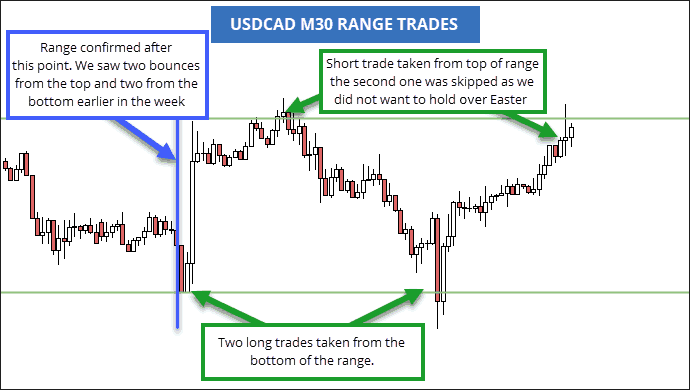

USDCAD has been moving sideways on the daily since the start of April. However, on the 1 hour chart you have an awesome range that has already given us three successful trades with a fourth trade still open and going well.

And these are just two examples from last week, there are many more.

We just aren’t getting those big moves that allow us to hit those big daily chart targets.

So at the moment trading lower time frames such as the H1, H4, H6 and H8 is actually safer and more profitable (at least for me).

The combination of lower time frames and looking for ranges is a simple yet powerful adjustment you can make to your trading.

Remember when I mentioned your win percentage can actually increase in slow market conditions?

Trading ranges is the reason why. We see more of them appear and they are extremely profitable to trade because of their reliability and predictability.

These ranges are essentially reversal trades repeated over and over again. You will benefit a lot from trading ranges by practicing your reversal trading skills.

Still Want to Trade Large Time Frames?

Trading large time frames is not completely off the table.

Despite the slow movement I am still trading the daily charts using my free price action strategy.

While trades take longer to reach target than they did last year the strategy is still profitable.

Follow My Trades

I try to share every trade before I enter it via my daily YouTube analysis and email alerts. If you want to trade with me you can get my analysis here.

If you have any questions feel free to ask below and I will help you out!

Comments are closed.