Strong Price Action Set Ups

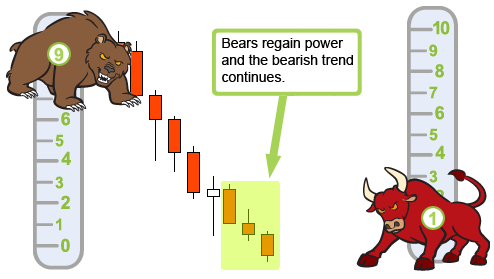

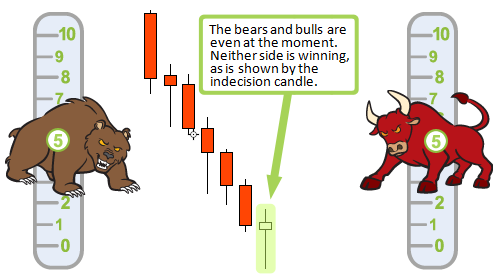

By this point, you should have a pretty good understanding of reversal trades and what constitutes a strong reversal. However, you are not ready to trade reversal trades yet. Remember the second part of a reversal trade? I call it the Indecision Candle. When an Indecision Candle forms in a trend it indicates indecision, not a reversal. For example, in the image below you can see a bearish preceding trend followed by an Indecision Candle.

Right now the Bulls and Bears are on pretty much equal footing. This indicates indecision. At this point, the market can go either way. We hope that it reverses so we can take a long trade and make some pips. However, it is entirely possible that the Bears will win the struggle and will continue to push down.

See the problem? You understand the mechanics of a reversal and how to spot strong potential reversals. However, this knowledge is worth nothing if you cannot filter out bad reversal set-ups.

So what’s the trick? I use Support and Resistance and Candlestick Analysis together. Using these two forms of analysis together is highly beneficial. Let me show you why.

The green highlighted area on the chart above is a support area. In a support area you will find a grouping of Buyers. The yellow highlighted area shows a strong bearish preceding trend heading into the support area.

Since this is a support area, I know that the Bears may have trouble breaking through this area. So if a Long Wicked Pattern forms in this area I will see it as a strong sign that a reversal might form. This is because two different forms of Price Action Analysis are telling me the same thing – Support and Resistance and Candlesticks. The Long Wicked Pattern is telling me that the Bears are losing strength and the Bulls are gaining strength. The area of support is telling me to expect Buyers in the area.

Trade Triggers

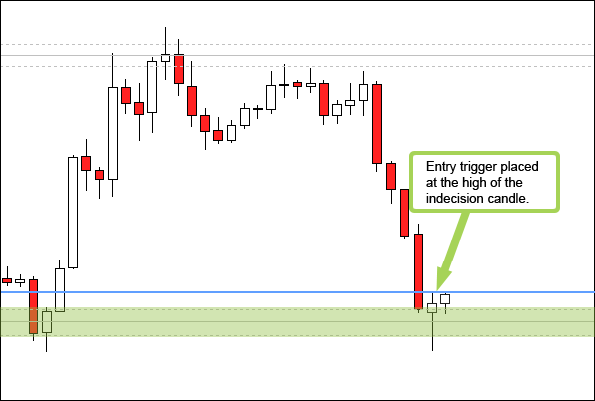

Now that you know how to pick out the best reversal set ups, the final step is to know when to enter a trade. Even the strongest reversal set ups sometimes do not grow into reversals. So I want to see some confirmation that the preceding trend is dead and the reversal trend has begun, before I enter a trade.

When a reversal trend begins to form, after a Long Wicked Pattern, I set a significant high/low as a trigger. A significant high/low is a minor Support and Resistance area which, when broken, indicates that the trend is strong enough to continue.

In the image above, you can see the Long Wicked Pattern has a strong preceding trend and a strong Indecision Candle. You can see that the reversal trend is just beginning to form. At this point, I cannot be certain that the reversal trend will fully form. So I have placed a significant high at a minor area of resistance. If the Bulls have enough strength to break through the minor area of resistance it indicates to me that the Bulls are in control. So this is my trigger to enter a long trade and capitalize on the bullish reversal trend.

I use two main types of significant highs/lows; Psychological Levels and the high/low of Indecision Candles.

Psychological Levels

Levels that end in a rounded number. For example, on EUR/USD your major Psychological Levels would be:

- 1.3000

- 1.2000

- 1.1000 and so on…

Your minor Psychological Levels would be:

- 1.3250

- 1.3200

- 1.3150

- 1.3100

- 1.3050

- 1.2950

- 1.2900

- 1.2800

I use both major or minor Psychological Levels as significant highs and lows.

High/Low of Indecision Candles

If the closest major or minor Psychological Level is not suitable, I will sometimes use the high/low of the Indecision Candle. Below is an example of placing the entry at the high of the Indecision Candle.

Placing your entry at the high/low of the Indecision Candle is as effective as a Psychological Level. However, it is not always an option, as sometimes the wick is too big or too small.

There is no precise distance from the Indecision Candle that I place my significant high/low. I do this all by eye, because it depends greatly on the pair I am trading and market conditions. The trick is to not place the significant high/low too close or too far from the Indecision Candle.

I know this sounds hard, but don’t worry it is easy to learn where to place significant highs/lows. All you need to do is start placing them and get a feel for the best placements. If you have trouble you can always look at the trade examples on my forex blog. There you will see where I place my significant highs/lows.

Entering Trades

Entering trades is a relatively simple process. Once the significant high/low is crossed by 3-5 pips the trade is opened.

You should also go through the free Forex course in which I show you how to put together a trading and money management plan. The free video course teaches you a lot about targets and stops.